Investment update - October 2023

Market update

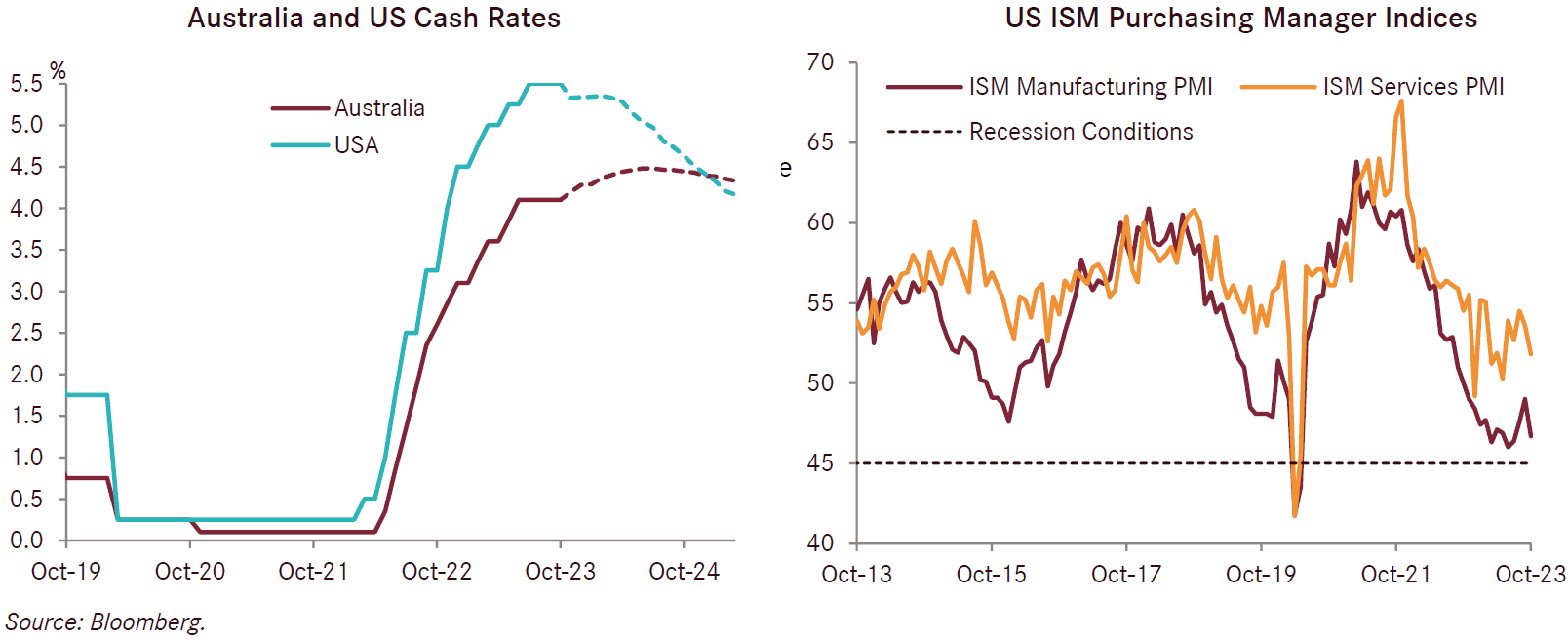

Bond and share markets alike continued their downwards slide in October, as investor sentiment was rocked by rising long-end bond yields despite emerging economic weakness and the outbreak of war in the Middle East. Economic indicators slipped further into negative territory across the world, boosting belief that central bank policy tightening were having the desired effects, and conversely that an end to the rate hike cycle is in sight. However, while leaving cash rates unchanged at their most recent meetings in late October and early November, the US Federal Reserve (US Fed), the Bank of England (BOE) and the European Central Bank (ECB) all reiterated that policy rates will need to be kept high to bring inflation back to target levels and as such it will be some time until any cash rate cuts are likely to occur. Australia remains out of step with other advanced economies with the RBA increasing the cash rate by 0.25% to 4.35% at its November meeting after stronger than expected inflation data. Uncertainties around the regional implications of the war in Gaza as well as the direction and timing of future central bank policy action resulted in increased volatility across all asset classes and commodity prices during October.

In Australia, the RBA increased the official cash rate by 0.25% to 4.35% in early November, after having left the cash rate unchanged at the previous four meetings. This move was widely anticipated after headline inflation had re-accelerated to 1.2% in the September quarter, up from 0.8% the previous quarter, due to rents and services. Nevertheless, on an annual basis headline CPI fell to 5.4% this quarter compared to 6.0% the previous quarter. Core inflation was 1.2% for the September quarter and 5.2% year-on-year, compared to 5.5% year-on-year in the previous quarter. The most significant price rises in the quarter were petrol (+7.2%), rents (+2.2%) and electricity (+4.2%). Rental prices have risen 7.6% annually reflecting low vacancy rates, with data indicating net overseas migration of around 500,000 in 2023, which is putting pressure on all aspects of housing. Following the rate rise in November, the market is pricing a 35% chance of a further rate hike by the end of Q1 2024.

Australia’s employment data showed further signs of weakness in September. Employment rose by 6,700 in the month. Jobs growth was led by part-time jobs, which rose by 46,500 against a fall of 39,900 for full-time jobs. Hours worked fell by 0.4% in September, consistent with the rotation from full time to part time work, following a 0.5% fall the previous month. Despite this, the unemployment rate unexpectedly declined from 3.7% to 3.6%, as a higher proportion of people moved from being unemployed to not in the labour force, another sign conditions are starting to ease. In contrast, retail sales increased 0.9% month-on-month in September, well above consensus of 0.3%, which is suggestive of resilience in the Australian consumer, with elevated population growth a key tailwind for consumer spending growth.

In the US, the yield on 10-year US Treasury bonds continued to surge higher in the first half of October, peaking at 4.99%, and being only a few basis points from exiting an inverted yield curve (US 2s/10s) for the first time since July 2022. Key factors driving yields higher included strong Q3 GDP data and the deteriorating outlook for supply and demand dynamics for US Treasury bonds. US Q3 GDP was 4.9% annualised, well above consensus at 4.3% and the 2.1% recorded in Q2. Growth was underpinned by strong consumer spending which rose 4.0%. Since that time, yields retraced back to around 4.5% by early November. A major catalyst was the release of weak US employment data for October, which reduced the prospect of any further cash rate increases. US non-farm payrolls rose by 150,000 in the month, below the 180,000 expected by consensus. There was a revision to August and September numbers, down 101,000. Most of the new jobs added in private services were in education and health care; cyclically sensitive growth in the private sector was very modest. The unemployment rate rose by 0.1% to 3.9% and the increase in average hourly earnings was less than expected, consistent with the slowing Employment Cost Index wages data of 1.1% growth in the three months ending September. The US Fed wants to see wages growth moderate to 3-3.5% to allow inflation to get back to the 2% inflation target. Consistent with slowing conditions, the University of Michigan consumer sentiment for the US fell to 63.8 in October from 68.1 the previous month. Within the survey, deteriorating expectations over business conditions and worries over consumers’ own personal finances fell sharply. The ISM Manufacturing PMI slipped to 46.7 in October from 49.0 the previous month. However, the US ISM Services PMI came in at 51.8, while lower than the previous month, remained at expansionary territory.

The US headline inflation rate remained steady at 3.7% in the year to September, while core inflation fell by 0.2% to 4.1% but remained well above the 2% target. The US Fed kept the cash rate unchanged at its meeting in early November. Hawkish comments by US Fed Chairman Powell in early November included that “we are not confident we have achieved the stance to bring inflation back to target” and that “going forward, it may be that a greater share of the progress in reducing inflation will have to come from tight monetary policy restraining the growth of aggregate demand”. Despite this, the market is pricing around 80 basis points of rate cuts in the US in 2024.

Europe and the UK are both experiencing above target inflation and close to zero growth. Inflation continued to fall in Europe, with annual headline inflation of 2.9% in the year to October, well below the 4.3% for September. Core inflation fell from 4.5% to 4.2%, however remains meaningfully above the ECB’s 2% target. The initial release for Q3 GDP in the Eurozone was -0.1%. Both the GDP and inflation data are consistent with the ECB’s current refinancing rate of 4.5% as the cyclical high and the ECB kept rates on hold in October. The UK headline inflation rate remained steady at 6.7% in the year to September. Core inflation fell by 0.1% to 6.1%. The BOE voted 6-3 in favour of maintaining the cash rate at 5.25% at its November meeting, but emphasised monetary policy is likely to remain restrictive for an extended period to steer inflation back towards their 2% target.

The Bank of Japan (BOJ) left its policy rate unchanged in its October meeting (cash rate at -0.1% and 10-year bond target of 0%), however introduced further flexibility to its yield curve control program. The BOJ now views the 1% cap on 10-year Japanese Government Bonds (JGBs) as a reference rather than an enforceable ceiling. 10-year JGBs subsequently traded at a yield of 0.96% in early November. Accompanying the decision, the BOJ increased its inflation outlook with core CPI now seen at 2.8% in FY23 (+ 0.3%) and 2.8% in FY24 (+0.9%), which compare to a 2% target level. Governor Ueda cited the Spring wage negotiations for next year as a key consideration for the timeline towards policy normalisation.

China’s GDP grew by a faster than expected 1.3% in the third quarter, up from 0.5% in Q2, improving the chances of meeting the 5% growth target for 2023. The Manufacturing PMI fell to 49.5 in October from 50.6 in September with foreign sales declining amid sluggish global economic conditions. Consumer prices fell by 0.2% in October impacted by the housing slump, weak consumer confidence and weak demand for Chinese made-goods leading to falling exports. China has stepped up monetary and fiscal easing in recent months to aid growth. On 24 October China approved a 1 trillion yuan (137 billion US dollar) sovereign bond issue to support the economy via infrastructure investment. This will widen the budget deficit from 3.0% to 3.8% of GDP.

Asset class returns in the month of October were very similar to those recorded the previous month. Cash was again the only major asset class to record a positive return in the month as higher bond yields led to losses across both listed equity and fixed interest asset classes. Equity markets experienced relatively large falls with Australian equities returning -3.8% and developed overseas equities -2.7% (on an Australian dollar hedged basis). The rise in yields also led to capital losses across bond markets, with global fixed interest falling -0.8% for the month, and Australian fixed interest falling -1.8%. Commodity prices were mixed and volatile, heavily impacted by the Israel-Hamas conflict. Gold was up 6.8% for the month whereas West Texas Intermediate Crude Oil fell by 10.8%, after rising strongly the previous month. Reflecting the risk-off environment, the Australian dollar fell against all major currencies during October.