Investment update - October 2022

Market update

October saw continued uncertainty around the global economic outlook, with high inflation and ongoing central bank policy tightening failing to significantly curb household consumption or robust employment in many economies. Nonetheless, hints are emerging that a number of central banks are expected to ‘pivot’ to a slower pace of rate hikes in the coming months amid a generally less optimistic economic backdrop as 2022 draws to a close.

The IMF’s latest World Economic Outlook was released in October. As expected, the update struck a more pessimistic tone compared to the prior release in July 2022. While the IMF’s forecast for global real GDP growth in 2022 remained unchanged at 3.2%, its 2023 forecast was cut by 0.2% to 2.7%, with the IMF noting that the worst of economic weakness was ‘yet to come’. It also expects that 2023 will feel like a recession to many, with over one-third of the global economy likely to experience two consecutive quarters of negative growth. Global inflation, meanwhile, is expected to peak at 8.8% in late 2022 before falling to 6.5% in 2023 and 4.1% in 2024.

Following their election in May 2022, the Australian Labor Party delivered its first federal budget in late October. While the government’s coffers were in a stronger position than previously anticipated due to rising global commodities prices, forecast increases in inflation and a weaker economic outlook suggest fiscal challenges in coming years. The budget mainly focused on easing cost of living pressures via enhanced childcare, aged care, and affordable housing support. Due to the increased spending and rising debt costs, the government forecasts that the better-than-expected A$32 billion deficit in the 2021-22 fiscal year – A$16 billion better than forecast in April - will increase to a peak of A$51.3 billion in 2024-25, with net debt to rise from 22.5% to 28.5% of GDP over the same period.

The nation’s third quarter inflation print was released in late October, coming in at 1.8% for the quarter, well above forecasts. The headline figure has now increased to 7.3% year-on-year, while the core figure also increased to 6.1% yearon- year – both at their highest level since the early 1990s. Increases in housing construction and utilities costs were the key drivers of the increase, however the data suggests robust inflation is becoming broad-based, with 9 of 11 major CPI basket categories recording price increases above the RBA’s target range. Indeed, the forecast peak inflation rate of 7.75% by year-end presented in October’s budget already appears to be below the likely figure, with the Reserve Bank of Australia’s (RBA’s) early November forecasts now suggesting an 8.0% peak level of price growth in late 2022, with CPI easing to a nonetheless historically high level of over 3.0% in 2024. Meanwhile jobs data for September was unchanged month-on-month, with the unemployment rate remaining at around 3.5%, with the participation rate remaining flat while the size of the labour force grew marginally.

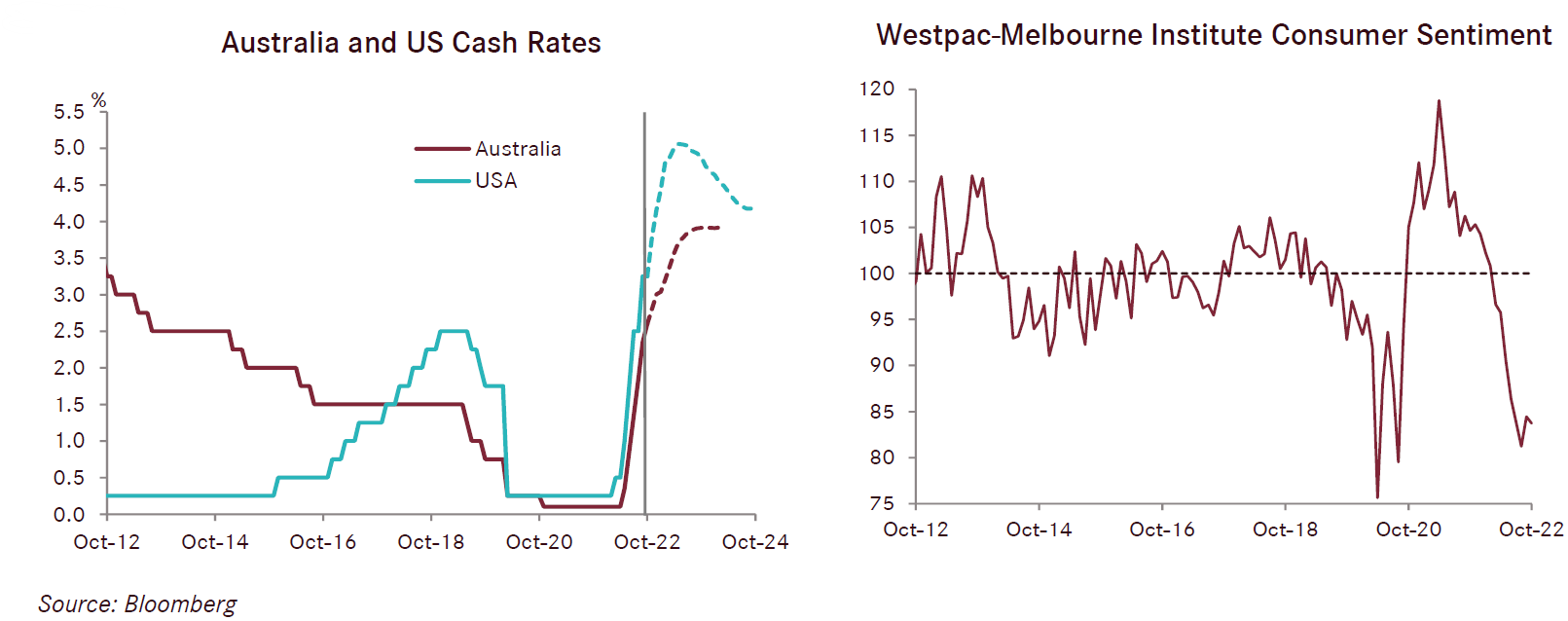

Despite the slower-than-expected pace of RBA hikes in October, the latest Westpac-Melbourne Institute consumer sentiment survey recorded a 0.9% increase to a very poor 83.7; a figure only marginally above pandemic-era record lows.

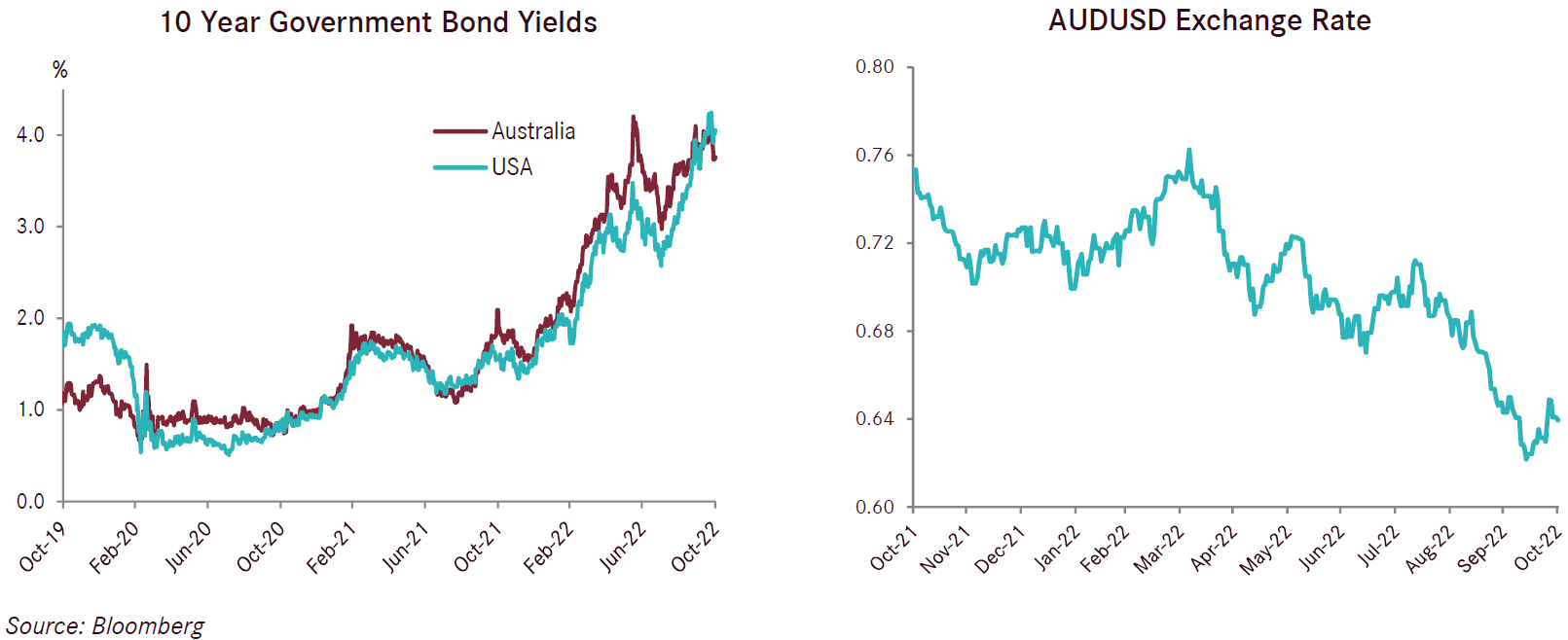

While the above-expected inflation print suggested some potential for a return to 0.50% rate hikes, the RBA’s 1 November meeting met consensus forecasts by hiking the cash rate 0.25% to a nine-year high of 2.85%. The RBA noted it that it remains resolute in its goal to return inflation to the target range of 2% to 3% per annum, and its signalling suggests more rate hikes are to come. That said, it reiterated that the effect of policy tightening will take time to curb consumption and feed into economic data, suggesting the possibility it may halt hikes in the coming months to evaluate their economic impact. Market pricing post-RBA meeting continued to support multiple 0.25% hikes in the coming months, with a terminal rate of just under 4.0% expected by mid-2023.

The ongoing hiking of interest rates continued to drive Australian house prices lower, with prices across the major capital cities falling 1.1% in October, taking annual price growth to -3.1% nationwide. While the pace of declines softened over October relative to prior months, prices are nonetheless expected to continue falling as credit availability contracts. Prices in the largest city, Sydney, are now down over 10% from their early 2022 peaks, but remain comfortably above prepandemic levels.

US data continues to reflect a slowing economy, albeit with considerable uncertainty as to whether the Federal Reserve will succeed in its precarious balancing act of containing inflation without triggering a recession. Third quarter US real GDP data posted the first quarterly increase in 2022, reversing the slightly negative growth over the first half of the year and rising 0.6% for the three months to 30 September. The result takes the annual figure to 2.6% and was broadly in line with expectations. Despite the positive print, the data suggests consumer spending is slowing as inflation erodes purchasing power, while the brisk pace of central bank rate hikes led to sharp contraction in the housing sector, including construction. This decline in private sector demand is likely to weigh on output going forward.

US inflation, meanwhile, again surprised to the upside, with headline CPI rising by 0.4% over September, and the core rate rising 0.6%. That said, the year-on-year rate, at 8.2%, has eased for the third month in a row, and is nearly a full percentage point below the peak annual rate of 9.1% in June 2022. Food inflation also appears to have peaked, as have prices for shelter.

As widely expected, the Federal Reserve raised its target rate by 75 basis points for the fourth consecutive time in early November to a new range of 3.75% to 4.00%. While post-meeting hints from Chair Powell that the December hike may potentially be less aggressive triggered a stock market rally initially, subsequent clarification that he expected cash rates to peak at a higher level than previously expected pushed equities downward. Market pricing post-meeting was split between either a 50 or 75 basis point hike in December, with the target rate expected to peak above 5% in the first half of 2023.

With the US Congress midterms looming on 8 November, current polling suggests a close race in both houses. In the House of Representatives, the Republican Party is expected to gain a slight majority, while Senate forecasts are too close to call. In the event of a 50-50 seat split between the parties in the Senate, the Democrats will retain control of the upper house by virtue of the tiebreaking vote of the incumbent Vice President, Kamala Harris.

The European Central Bank (ECB) made another outsized rate hike in late October, raising the cash rate by 0.75% to 1.5% - the highest level since 2009, with suggestions of further hikes to come. While the ECB has not signalled the future rate path, a 0.5% increase is anticipated in December. This is supported by the latest Eurozone inflation data, with prices smashing forecasts to rise by a record high of 10.7% year-on-year in October. Energy remains the main driver, rising by 42% year-on-year, while food and alcohol have also increased by a material (but much lower) 13%. The rate hikes have been perceived as likely to trigger a more dovish approach in 2023, with demand in the region showing signs of weakening.

There was further political turmoil in the United Kingdom over the month. After the new Conservative government’s unfunded and highly stimulatory ‘mini-budget’ in September triggered an enormous spike in gilt yields – requiring Bank of England liquidity intervention in the bond market to avert the potential collapse of multiple pension funds – Chancellor of the Exchequer Kwasi Kwarteng was sacked by new Prime Minister Liz Truss, who was in turn forced to resign as Prime Minister a week later after just 44 days in office – the shortest term in history. Her successor, Rishi Sunak, was also Kwarteng’s predecessor, and is expected to manage government finances in a more fiscally conservative manner.

As with the UK, the key development in China over the month was also a political one, with the National Party Congress concluding with President Xi further consolidating his power by appointing his political allies to the Politburo, and being confirmed for a third term as leader. Xi’s increased stranglehold on power initially rattled markets, however improved third quarter GDP data appears to have assuaged investor concerns to an extent. Risk assets rallied in October, offsetting recent declines, with rising expectations of central bank pivots providing a tailwind. Australian equities returned 6.0% for October on a total return basis, while developed overseas equities soared 7.2% in AUDhedged terms. The recovery failed to drive annual returns back into positive territory however, with Australian and fullyhedged developed overseas equities returning -2.6% and -16.1%, respectively. Fixed interest performance was more muted, with yields rising moderately during the month while credit spreads narrowed. Australian and overseas fixed interest returned 0.9% and -0.4% for the month, respectively. The RBA’s comparatively dovish policy tilt relative to major central banks contributed to a further fall in the AUD, which declined 0.5% over October, taking the three month drop to 8.4%.