Investment update - August 2023

Market update

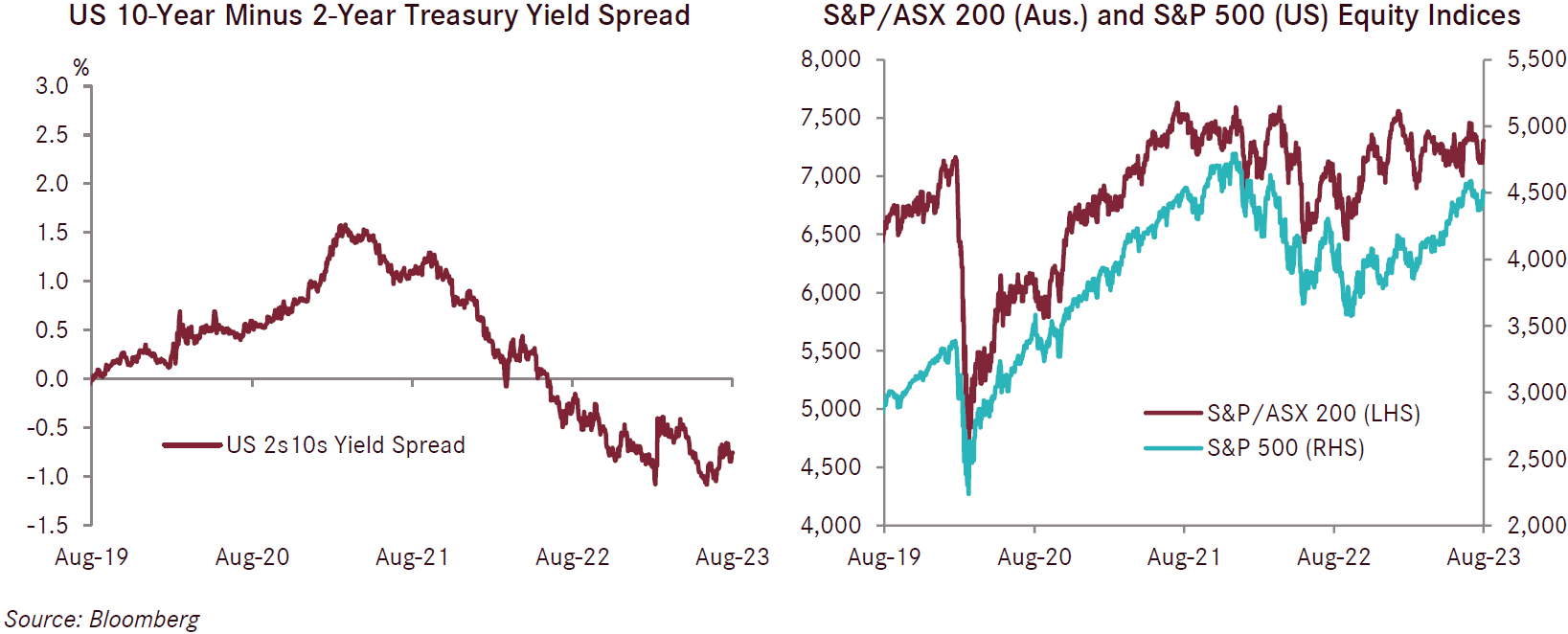

Markets see-sawed in August, partially reversing last month’s bullish tilt as investors touched the brakes on risk assets. This shift arose from the “higher for longer” interest rate narrative gaining greater traction, as central banks remained firm in their commitment to reduce inflation to its target level. In addition, China’s economic recovery post-COVID-19 lockdowns continued to underwhelm investors, with a flurry of weak economic data releases disappointing expectations. However, more data releases late in the month bolstered hopes for a scenario that sees central banks successfully bringing inflation down to their targets without incurring significant economic damage.

In Australia, the monthly Consumer Price Index (CPI) report revealed that year-on-year headline inflation for July fell to 4.9% from 5.4% in June, benefitting mostly from goods disinflation. Driving this was reduced household spending on goods, which fell -4.1% through the year to July (whilst spending on services increased 2.4%). The CPI trimmed mean, which is considered a more pertinent gauge by the Reserve Bank of Australia (RBA), also fell from 6.0% the month prior to 5.6%. Annual price reviews across all capital cities saw Australian electricity prices post a large annual increase of 15.7% in July. Without rebates from the Energy Bill Relief Fund, consumers’ electricity prices would have risen 19.2% in the month. Rent inflation continues, with rents increasing 7.6% year-on-year up from 7.3% in the prior month, highlighting the present tightness in rental markets. Meanwhile, inflation for new dwellings continues to fall, with the slowing rate of price growth reflecting a softening in new demand as well as a partial resolution of supply issues for raw materials.

Employment data for July, released mid-August, slightly dampened Australia’s economic resilience story, with the seasonally adjusted unemployment rate rising to 3.7% from 3.5%. However, June’s reading the month prior had been only a few basis points above the historical lows reached in 2022, and the labour market remains extremely tight in Australia.

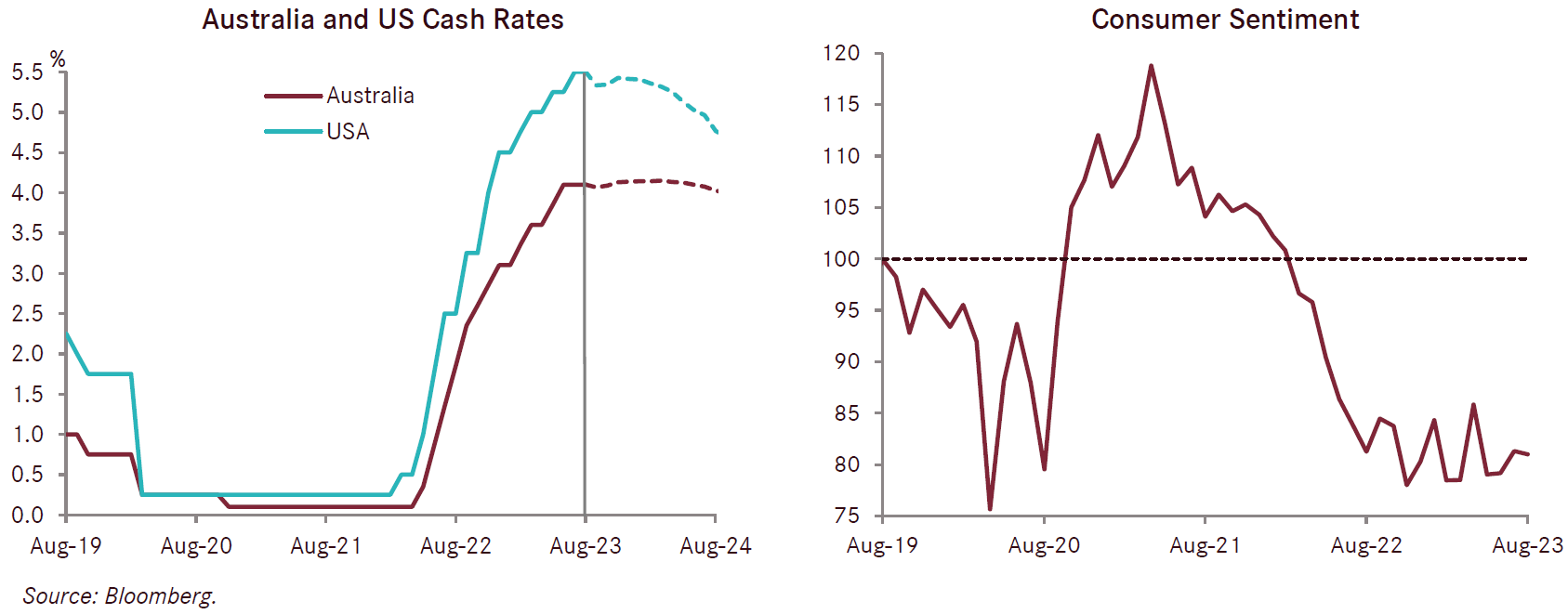

Australian sentiment indicators continued to suggest a mixed outlook. The NAB survey showed business conditions falling one point to +10, while business confidence increased 3 points to a slightly positive +2. Consumer sentiment as measured by the Westpac-Melbourne Institute, however, remained deeply pessimistic and close to historic lows, falling 0.4% to 81, with concerns around continued RBA rate hikes and cost of living pressures cited as the main contributors to the decline.

The RBA left the official cash rate unchanged at 4.10% for a third consecutive month in early September. In his statement accompanying the decision, the outgoing Governor Lowe cited continued evidence of inflation declining from its peak and uncertainty regarding the economic outlook as reasons to pause. However, he also made clear that services and rent inflation remain too high, and that the RBA’s central case forecast is for CPI to reach its 2-3% target range only in late 2025. Market reaction to the widely-expected pause was predictably muted, as market pricing suggests rate cuts may commence in 2024. Most economists still expect one more hike before year-end, however. This meeting was also Lowe’s last as RBA Governor, with Michelle Bullock to be appointed the top job in mid-September.

In the US, the publication of the minutes to the July Fed meeting sent US Treasuries to their highest levels since October, as the tone did nothing to shade market fears of a “higher for longer” scenario. The main Federal Reserve event of August came late in the month as Federal Reserve Chair Jerome Powell struck a hawkish tone at the annual economic symposium at Jackson Hole, reiterating that the Fed’s job isn’t over as “inflation remains too high”. However, Powell’s commentary only played into an existing rate narrative that the market had priced-in earlier in the month, and as such, treasury yields only modestly rose, while US equities even had a mostly positive reaction to the speech. Hopes for a “Goldilocks” scenario playing out in the US were bolstered in early September as evidence of a US labour market cooling came through. For example, unemployment edged up to 3.8%, against expectations that it would remain at 3.5%, and monthly wage growth of 0.2% was also lower than forecasts, with both aided by an above-consensus increase in labour force participation. Core inflation has fallen to 4.7%, continuing its downwards trajectory from its 6.6% peak in September 2022.

US Purchasing Manager indices (PMIs) rallied in August. The US ISM Manufacturing PMI climbed to 47.6 in August from the previous month’s 46.4 and ahead of the market consensus of 47.0. A stronger than expected US ISM Services PMI came in at 54.5, up from 52.7 in July, and against a consensus expectation for a dip to 52.5. However, despite evidence of bolstered consumer spending in recent months, the US Conference Board Consumer Confidence indicator fell in August, erasing backto- back increases in June and July, with consumers particularly concerned about the rising prices of food and energy.

Europe and the UK are facing a far more persistent inflation problem than the US, as core inflation prints of 5.3% and 6.9% respectively, linger just below historical peaks reached earlier in the year. A key pressure point has been wages, as hourly wage growth remains near all-time highs for both Europe and the UK at 5.0% and 8.2% respectively. As such, markets are expecting a further hike from the European Central Bank (ECB) in September and two more from the Bank of England before the end of 2023. This contrasts with the consensus pulling back expectations to assign less than a 50% chance of a further hike in the US. Of increasing concern has been Germany’s wage growth, which increased to 6.6% this quarter to be above inflation. Whilst positive real wage growth is a tailwind for consumers and the economy, it threatens to prolong inflation and could trigger further actions from the ECB.

China’s economic growth concerns resurfaced in August. The economic growth and inflation data both came in weaker than expected, prompting an unexpected rate cut, rule changes on equity trading, and mortgage rate cuts. Property sector stresses continued with bankruptcy filings by some of the country’s largest real estate developers. The Chinese Caixin Services PMI fell to 51.8 from 54.1, undershooting expectations for a fall to 53.5. China’s waning consumer demand and slower manufacturing is having reverberations across Asia, as neighbouring countries are experiencing spillover effects on their exports and manufacturing sectors, consistent with the adage that “when China sneezes, Asia catches a cold.” Japan has been no exception to this. The Japan Jibun Bank Manufacturing PMI was revised downward to 49.6 in August, as output shrank, new orders fell and foreign demand declined, albeit at shallower rates than the month before. The Bank of Japan (BOJ) only marginally relaxed its control over the 10-year bond yield in July; while retaining its target of zero, it has allowed a slightly higher upper bound. The BOJ’s approach to monetary policy continues to contrast with most other developed economies, where monetary policy has been tightened aggressively – this has given rise to yen weakness over the past year.

In August, equities reversed some of the prior month’s gains, although the losses were more subdued domestically, with Australian equities returning -0.8% relative to overseas equities at -1.9% (on an Australian dollar hedged basis). The main headwind to risk assets were rising yields due to hawkishness from central bankers, and concerns over China, which led emerging markets to be this month’s weakest equity class (after being the strongest in the month prior), returning -2.4% on an Australian dollar unhedged basis.

Global fixed interest experienced capital losses after a rise in yields in both the US and Japan, falling 0.3% for the month. The RBA’s decision to pause early in the month led to a capital gain for Australian fixed interest, returning 0.7% in August, while the Australian dollar depreciated against most other major currencies.