Investment update - February 2023

Market update

February saw a moderate reversal of January’s rally across both risk and defensive assets, with expectations of a higher terminal cash rate across a number of economies and persistently high inflation weighing on investor concerns. Amid ongoing geopolitical and inflationary worries, it is worth noting the impact of the COVID-19 virus continued to ebb as the pandemic approaches its third anniversary in mid-March; the rolling seven-day average of confirmed deaths globally has fallen to just over 500 per day – the lowest since the very first week of the pandemic in March 2020.

Australian economic data was overall negative for the month – fourth quarter GDP and job data disappointed, while a decline in inflation nonetheless suggested ongoing elevated price pressures for food and housing. Fourth quarter GDP data was released at the start of March and came in materially below consensus, growing by just 0.5% for the final three months of 2022, taking the calendar year total to 2.7%. Household spending growth was the key underperformer, eking out 0.3% in quarterly growth - well below the 1.0% increase over the third quarter. Disposable incomes continued to fall as cost of living expenses and rising interest rates took their toll, while savings rates also declined from over 7% to just 4.5%. Construction work and equipment spending also declined.

The latest monthly consumer price index reading also showed signs of cooling, with prices rising 7.4% in the year to end January compared to 8.4% over 2022. While evidence suggests that inflation may well have peaked, it remains well above the RBA’s target range of 2% to 3%. Additionally, food and housing both continued to soar, rising 9.8% and 8.2%, respectively. Significant rises in rents following renewed migration have buoyed the latter figure. Despite a tight labour market, wage growth was below consensus, rising 0.8% over the December quarter. Additionally, only one-fifth of private sector workers received a pay rise compared to nearly 50% over the September quarter.

Australian employment data reflected a weakening in the labour market, with the unemployment rate rising 0.2% to 3.7%. That said, there was also an increase in unemployed people set to commence a new job, while the decline in hours worked appeared to reflect above-average annual leave taken in January – quite likely at the behest of managers whose direct reports had accumulated considerable leave balances during the pandemic.

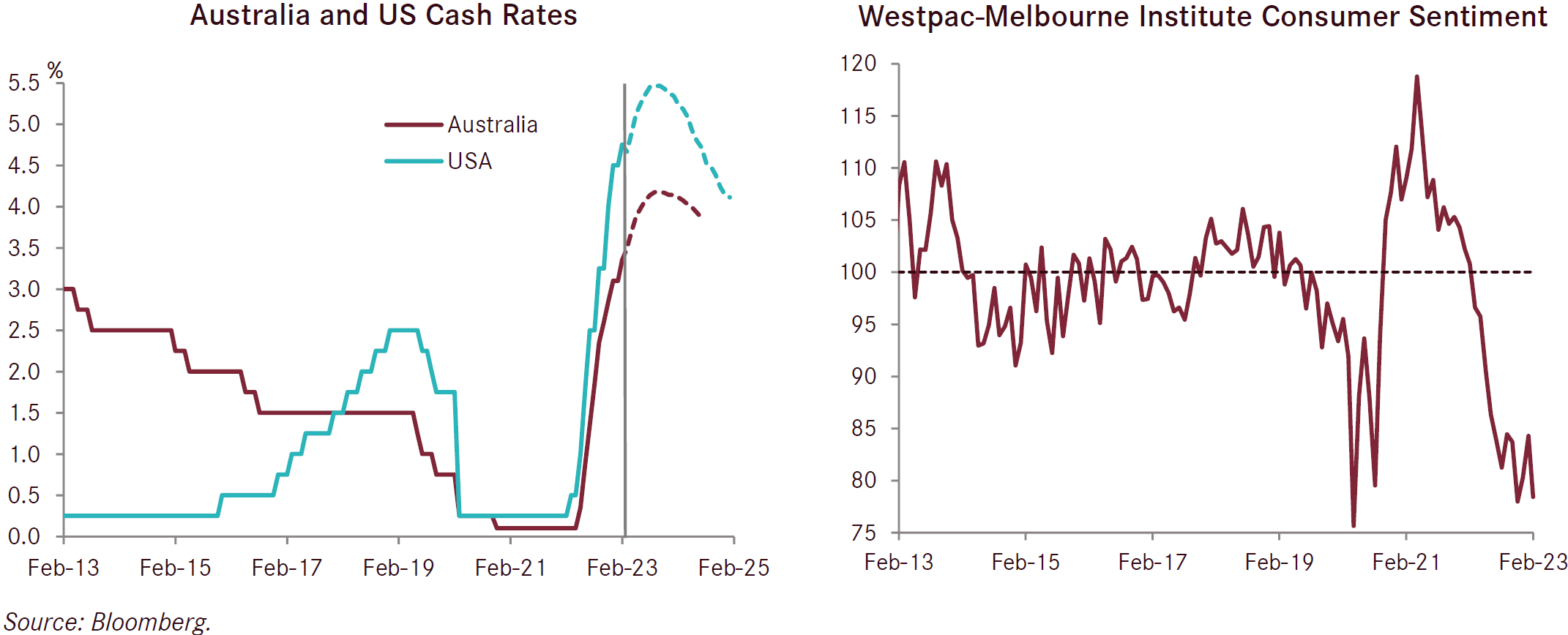

The Reserve Bank of Australia (RBA) raised rates as expected in early March, lifting the cash rate 25 basis points to 3.60%; the highest level since May 2012. While noting that additional policy tightening was expected, the RBA’s post-meeting statement struck a somewhat dovish tone, intimating the possibility that just one more hike (rather than multiple hikes) may be required. Market-implied pricing and economist consensus both suggest that at least two further hikes in the coming months are likely, with the terminal rate expected to peak at over 4% in mid-2023, with no cuts priced in until 2024 at the earliest.

The nation’s housing sector continued to show signs of decline, although prices did stabilise in some regions, leading to the RP Data/CoreLogic index recording a decline of 0.1% in February; its smallest fall since the first hike of the RBA’s cycle in May 2022. There was even a modest monthly increase recorded in the largest market of Sydney. Low supply volumes are likely to be a major factor behind the price support, as is the introduction of new stamp duty concessions by the New South Wales government. That said, dwelling approvals declined by a seasonally-adjusted 27.6% month-on-month in January; while volatile, the year-on-year figure was also weak at -8.4%. Residential construction also continued to decline, falling 0.6% in January.

Sentiment data was somewhat mixed for the month. Consumer sentiment gleaned from the Westpac-Melbourne Institute survey fell by 7% in February, with the index falling to a reading of 78.5. Persistent inflation and the RBA’s more aggressive anticipated path of rate hikes significantly weighed on household concerns. The NAB business survey suggested consumer spending has held up, with conditions swinging back 5 points after falling 8 points in December, while confidence similarly spiked 6 points for the month.

In the US, data suggests the economy remains hot despite the Federal Reserve’s sharp pace of rate hikes. Non-farm payrolls surprised to the upside, posting a gain of over half a million new jobs, with prior months’ data also revised upward. The unemployment rate edged lower to 3.4% - the lowest level since May 1969.

The latest US inflation data was in line with expectations, with the headline and core readings rising 0.5% and 0.4%, respectively. Core services inflation proved strong, with rent inflation particularly elevated. Despite meeting expectations, the print nonetheless reflects the persistence of services inflation and the challenge the Federal Reserve faces in controlling core inflation.

Ahead of the Federal Reserve Open Markets Committee’s next meeting on 22 March, market-implied pricing suggests a high likelihood of a return to a 50 basis point increase. While expectations of the March decision increased in recent days, there are also rising odds of a greater number of hikes this year, with a terminal target range of 5.75% to 6.00% in the second half of 2023 now considered an each-way bet. That said, market-implied pricing suggests cuts are likely over the following year and a half, bringing the rate down to around 4.25% to 4.50% by end-2024.

As the conflict in Ukraine rages on in the east of the country, the European economy remains in weak condition. Eurozone inflation remained broadly unchanged for February at 8.5% year-on-year, however came in at 0.3% above consensus forecasts. Core inflation remained stubborn, rising to 5.6%. GDP for the region posted a surprise expansion, rising by 0.1% for the fourth quarter. That said, it was only 0.2% above expectations of a slight contraction. A cooling of energy prices as the year drew to a close offered households and firms some respite, suggesting economic stagnation may be more likely than outright recession. The European Central Bank is expected to continue hiking rates at its next meeting in mid-March.

The Chinese economy appears to have favourably navigated the end of the Chinese government’s “zero COVID” approach, with both services and manufacturing sentiment improving. Official manufacturing PMI increased by 2.5 points to 52.6 – the sharpest increase in a decade - while the services gauge also increased to a comfortably expansionary 56.3. New orders and employment increased across the board, while service providers noted increased profit margins.

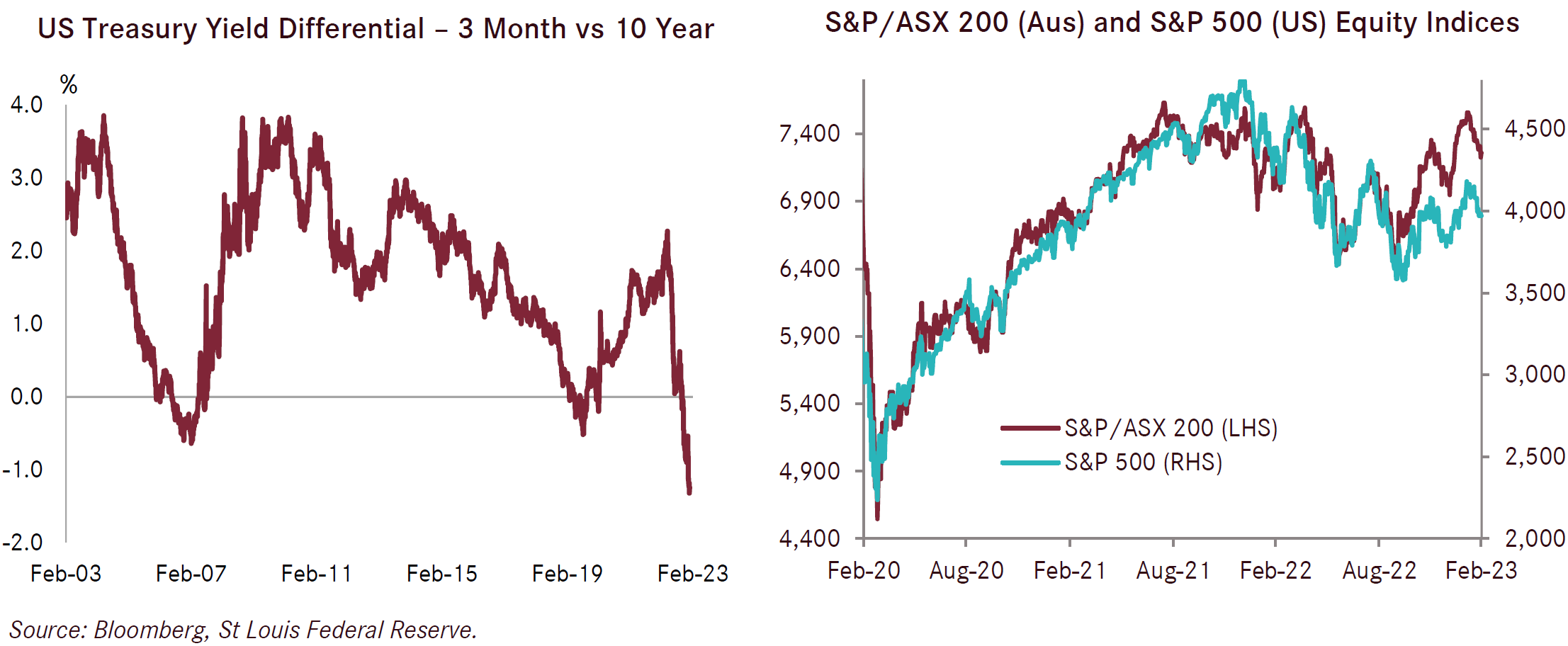

Equities declined over February, with signs of a more hawkish turn in policy settings in a number of economies suggesting higher terminal cash rates than previously anticipated. Developed overseas equities declined 1.6% on an Australian dollar-hedged basis, while Australian equities fell 2.6%. That said, annual returns for the latter remain at a healthy 6.5%; well above the former’s year-on-year return of -7.3%.

As with equities, increased rate expectations also led to fixed interest classes recording negative returns for February, with Australian and overseas bonds returning -1.3% and -1.8%, respectively. The US Treasury curve remained sharply inverted, with the 10-year Treasury yield rising from 3.4% at the start of February to 4% at the start of March. The 3- month Treasury bill yield, meanwhile, increased more modestly during the month, albeit rising to a still-high 4.85% at month end. After years of poor returns relative to both equities and fixed interest classes, cash was the strongest performer over both one and three months – were it not for the stellar performance of Australian equities, it would have also been the best performer over the past twelve months.