Investment update - September 2023

Market update

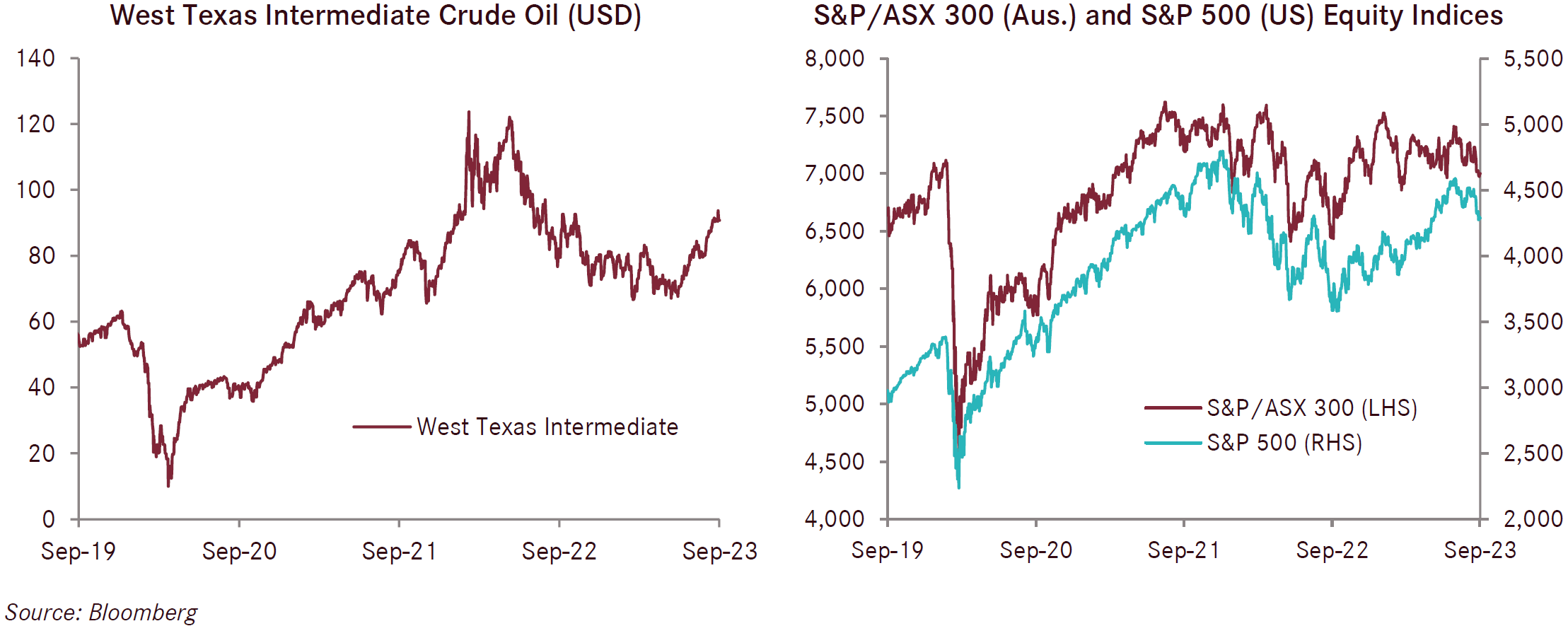

A quarter of steadily rising bond yields culminated in quickly deteriorating sentiment in September that engulfed markets and led to broad equity sell-offs. Steepening global yield curves were reinforced in September by an unrelenting narrative from central banks of a “higher for longer” interest rate path, whilst the West Texas Intermediate Crude Oil price also climbed to its highest level in over a year after having bottomed in June, adding to inflation pressures. This is creating headaches for central bankers, but also for consumers facing a cost-of-living crisis. As the US Federal Reserve tackles a stubbornly resilient US economy and correspondingly sticky inflation levels, the Bank of England (BOE) and European Central Bank (ECB) face an unenviable task of reducing inflation to target amidst growing concerns over their respective economies, and heightened likelihood of recession. Continuing market disappointment over the extent of China’s recovery post-COVID-19 lockdowns also remained this month, despite suggestions of more government support and better economic data.

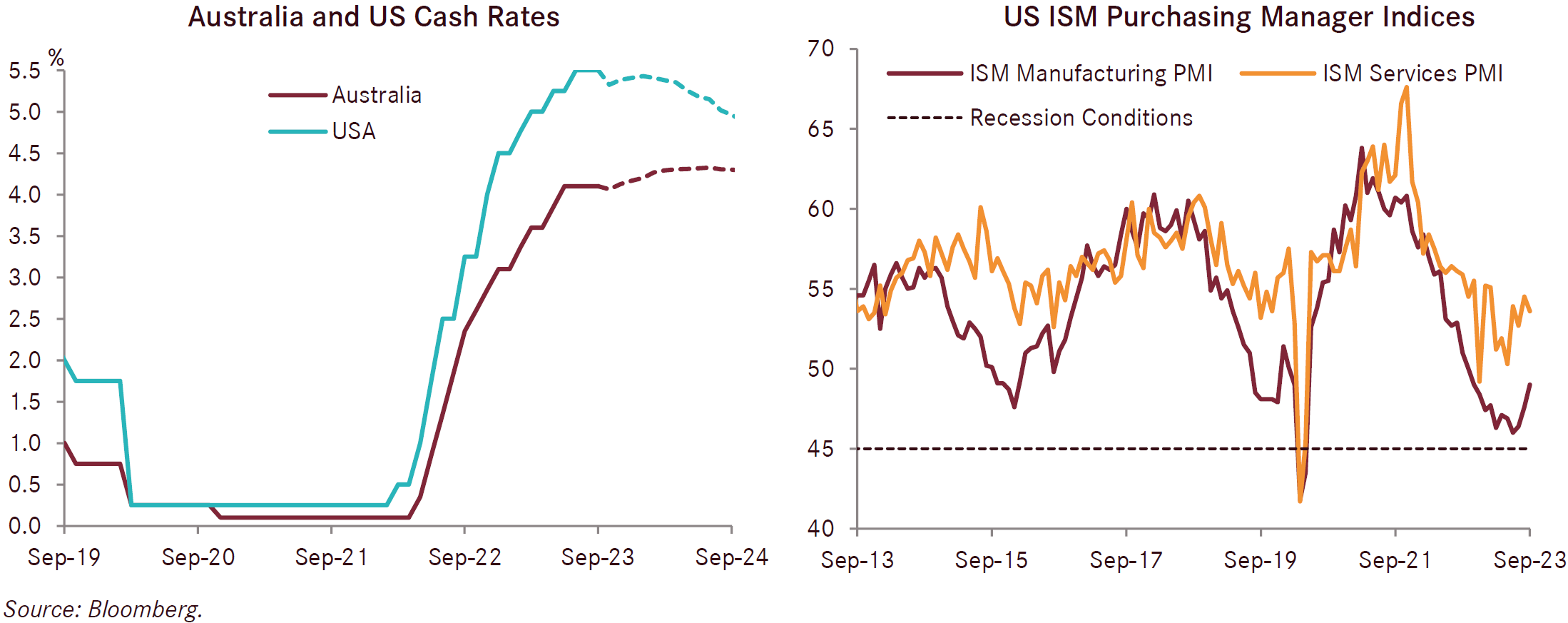

In Australia, year-on-year headline inflation for August rose to 5.2% from 4.9% in July, ticking upwards for the first time in four months. Driving this was a large surge in fuel prices in August of 9.1% (accounting for half of the monthly CPI increase), as well as food price increases. Housing inflation fell to 6.6% in August from 7.3% the month prior, and new dwelling prices rose by the lowest annual rate since August 2021 (4.8%), reflecting an improvement in supply conditions due to building material costs easing. Rent inflation continues, with rents increasing 7.8% year-on-year up from 7.6% in the prior month, highlighting the present tightness in rental markets. However, the core CPI measure (which excludes energy and food inflation) fell to 5.5% from 5.8%, giving the RBA some indication that policy tightening is having some of its desired effect on the real economy. Correspondingly, the RBA left the official cash rate unchanged at 4.1% for a fourth consecutive month in early October, which was a widely expected decision under Governor Bullock’s first meeting as governor. However, the market is pricing one final hike to occur at either of the November or December meetings before the peak policy rate is reached by the end of 2023.

In September, final budget outcome figures revealed that the Australian federal government had delivered the first fiscal surplus in 15 years, totaling A$22 billion for the last financial year. This budget surplus was largely a result of strong commodity prices, and higher than expected tax revenue from individuals and companies. However, the government’s intergenerational report is projecting fiscal deficits out to 2063, meaning the 2022-23 surplus may be an outlier.

In September, the NAB Monthly Business Survey demonstrated business conditions easing three points, but remaining above average at +11, while business confidence was steady at +1 point. Despite a rise of 2.9%, consumer sentiment as measured by the Westpac-Melbourne Institute remains deeply pessimistic and close to historic lows at 82 in October. The marginal boost to consumer sentiment was attributed to the RBA’s extended pause on rate hikes through the month, providing some relief.

In the US, the yield on 10-year US Treasury bonds hit their highest level since 2007, marking a 100 basis point jump over the quarter. This was in line with the resolute messaging from US Federal Reserve Chair Powell after delivering the September meeting’s decision to hold rates, that any relief from borrowing costs will be neither swift nor generous. Another key outcome from the meeting was the updated Fed Dot Plot’s 50 basis point upwards shift in the median cash rate at the end of 2024 to 5.1% from 4.6%, reflecting less cuts through 2024. Providing some hope was the month-on-month Personal Consumption Expenditure (PCE) deflator print for August that was released in late September undershooting expectations at 0.1% against a 0.2% consensus, and the core inflation level falling below 4.0% for the first time in more than two years. A key event in September was the risk of an imminent government shutdown in October due to a lack of government funding, threatening a downgrade on US debt by Moody’s – the last major credit ratings agency to rate US debt as AAA. Whilst a stopgap measure was signed at the turn of the month to extended the deadline out to mid-November, analysts are concerned that a resolution will still not be reached before the new cutoff date.

Supporting Powell’s unwavering hawkishness has been further evidence of a tight labour market and resolute economy in the US in September. Initial jobless claims unexpectedly fell by 20k to 201k versus 225k expected and 221k the month prior, reaching its lowest level since January. US non-farm payrolls also strongly exceeded expectations to the upside in September, with payroll jobs up 336k against 170k expected, and was accompanied by a 119k net upwards revision to the prior two months. Additionally, the US ISM Manufacturing Purchasing Manager Index (PMI) beat expectations at 49 versus 47.9 expected in September from the previous month’s 47.6, whilst the US ISM Services PMI remains at expansionary territory at 53.6, consolidating the strong momentum for the sector despite tighter credit conditions. However, despite strong fundamental economic data, the US Conference Board Consumer Confidence indicator fell again in September, as consumers’ concerns over rising prices of food and energy dominated survey responses.

Inflation in Europe fell markedly in September to a two year low, with headline inflation declining to 4.3% from 5.2% and the core measure falling to 4.5% from 5.3%. These data releases were accompanied in September with what many analysts are predicting will be the final 25 basis point rate hike from the ECB for this rate hike cycle. However, with the current inflation level still more than double the ECB’s 2% target, Europe will likely be forced to endure the “higher for longer” narrative. This is a similar situation to the UK, where inflation lingers at even more problematic levels, only declining to 6.7% in August from 6.8% the month prior (September yet to be released at time of writing). The Bank of England (BOE) voted marginally in favour (5-4) of maintaining rates at 5.25% in September as opposed to another 25 basis point hike, remaining consistent with its messaging of prioritising keeping rates higher for longer over hiking more aggressively in the short term. Additionally, their concerns over the UK economy are growing, with the BOE cutting its forecast for economic growth in the July-September period to just 0.1% from August’s 0.4% forecast; this follows data released in September pointing to a European economic contraction for the quarter. As both Europe and the UK approach recessionary territory, central bankers are hoping to see inflation fall to target, providing some hope to consumers and firms for a dovish pivot.

Chinese authorities continued to deliver on a range of small measures in September to help stimulate its economy which has underwhelmed in its post-COVID-19 lockdown emergence. To help first home buyers, state-owned banks lowered their mortgage rates and governments eased mortgage eligibility. The positive impact of policies such as these are flowing through, with credit growth, industrial production and retail sales all up in September. Additionally, inflation in China has moved out of negative territory. However, Chinese property giant, Evergrande, continues to be source of pain for officials, having scrapped a debt restructuring plan due to poor property sales and legal investigations, with its share price falling -20% as a result. This triggered contagion fears in the sector, resulting in a broad sell-off of listed property developers, and is hampering the outlook on demand for construction materials, which will have negative flow-on effects to the global economy and particularly Australia.

In September, the adage of “Cash is King” was vindicated, as all other listed assets suffered losses in the month due to higher bond yields. Equity markets experienced large falls, although the losses were more subdued domestically, with Australian equities returning -2.9% relative to overseas equities at -3.8% (on an Australian dollar hedged basis). The rise in yields also led to relatively large capital losses across bond markets, with global fixed interest falling -1.8% for the month, and Australian fixed interest falling -1.5%. Energy commodities, namely oil, had a strong month on the back of announcements of extended output cuts, with the West Texas Intermediate Crude Oil going up 8.6% for the month, marking a 28.5% rise for the quarter. Whilst prices slid in early October, the Israel-Hamas conflict has triggered another rise in the prices of energy commodities.