Investment update - June 2023

Market update

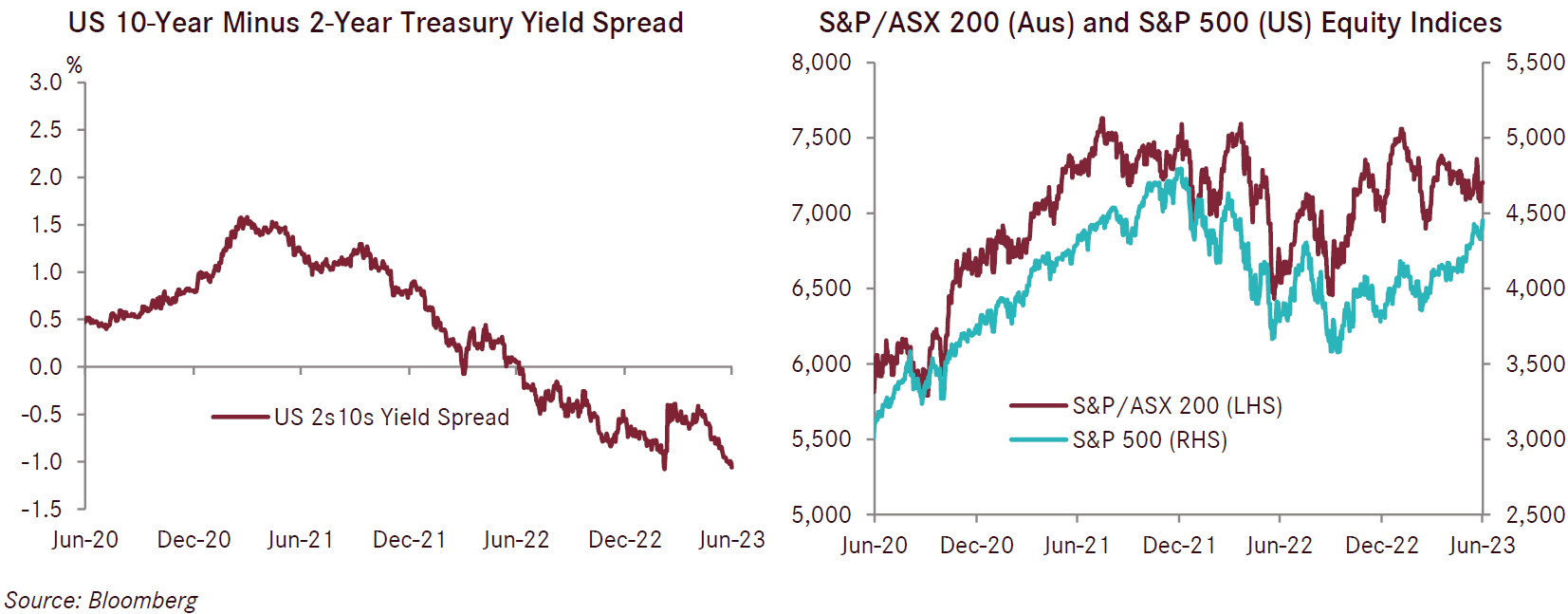

Markets continued to perform their monthly investor sentiment see-saw in June, positively rebounding from the caution demonstrated through May in response to a string of negative news flow in that month, primarily focused on volatile US debt ceiling negotiations which have since been resolved. The key theme across markets and economies through June has been a reluctant acceptance that rates will remain higher than expected in response to stubbornly high core inflation levels, overall economic resilience, tight labour markets, as well as the resolutely hawkish commentary from central bankers across the world at the ECB Forum on Central Banking held this month. As a result, market pricing for major central bank interest rate cuts previously anticipated to commence in 2023 have been pushed out to 2024.

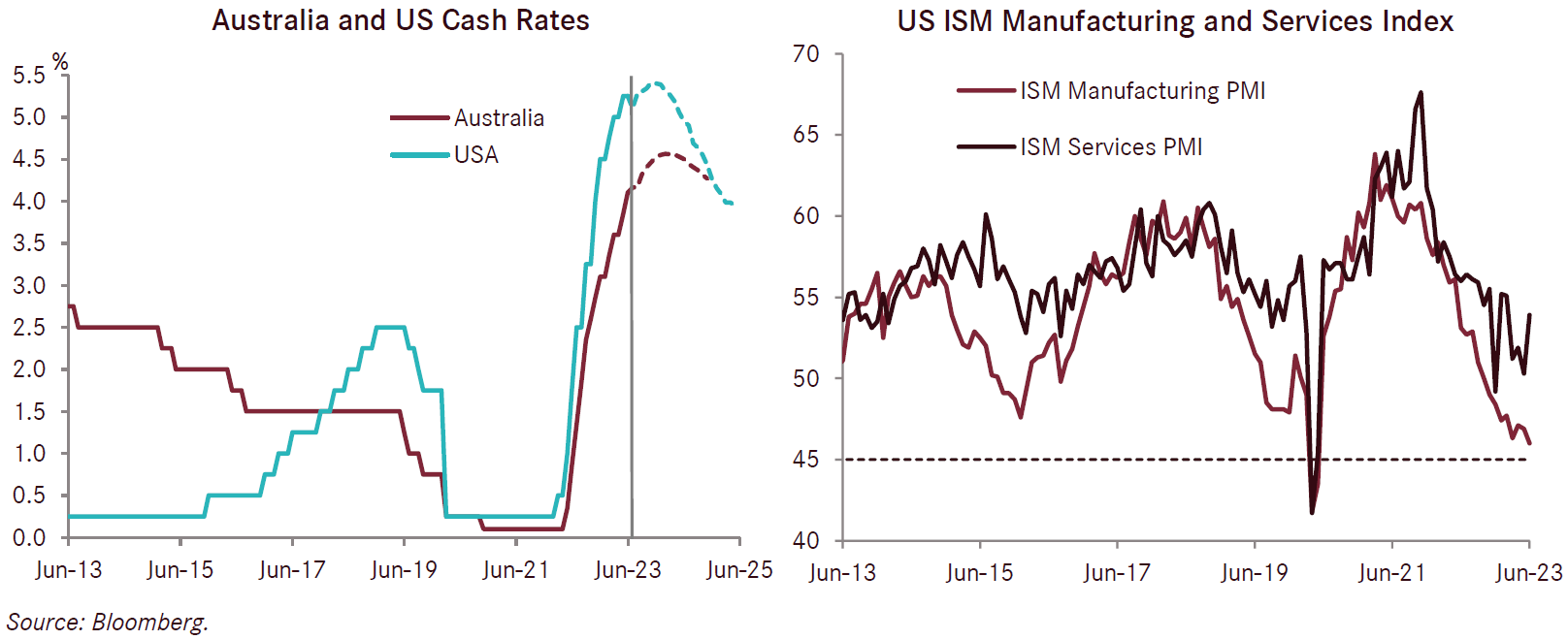

In Australia, the May monthly consumer price index (CPI) indicator was released and came in with a softer than expected headline of 5.6% year-on-year, beneath the consensus estimate of 6.1%, and falling from the 6.8% April level. This was driven largely by a -6.7% drop in automotive fuel prices in May due to increased oil production and a higher Australian dollar. However, there was little change in core CPI, which only marginally fell -0.1% to 6.4% year-on-year, signifying more persistent domestic inflation. Rising inflationary pressure continues to come from the rental market, with rents increasing 6.3% in the twelve months to May. The RBA responded to the CPI releases, partially surprising markets and economists in early June with another 25 basis point hike, bringing the official cash rate up to 4.1%. The RBA paused at the July meeting, likely in anticipation of the upcoming quarterly Statement on Monetary Policy (SoMP) due in August; this may follow the same precedent set in April prior to the May SoMP, which was immediately followed by consecutive hikes. Markets are currently pricing two more rate hikes in the remainder of the year.

Australian June jobs data continued to signal a very tight labour market, with the unemployment rate holding steady at a near-historic low of 3.6%, and job vacancies, though falling by -2.0% from February 2023, remaining 89% above pre pandemic levels in May. Alongside the resilient labour market, retail sales rose 0.7% month-on-month, far stronger than the 0.1% consensus. Housing data releases in June pointed to a stabilising housing market, with loan commitments rising by 4.8% month-on-month against a 3.4% consensus and coming after a -1.0% result in April. Dwelling approvals also surged in May, up 20.6% month-on-month against a 3.0% consensus, however this was the result of a 59.4% gain in the volatile attached dwelling approvals category (led by a spike in NSW apartment approvals), whilst detached approvals were only up 0.9% for the month.

The Westpac-Melbourne Institute Consumer Sentiment survey saw just an average 0.2% rise to 79.2 in May, with initial survey responses bouncing back in the first couple days from the -7.9% drop the month prior, but then tumbling toward lows in response to the RBA’s decision to increase interest rates by another 25 basis points. The NAB Business Conditions survey was unchanged at +9 June, remaining subdued after the decline in May. Business conditions were weakest in consumer-focused sectors such as retail, consistent with weak consumer sentiment and pointing to a softening outlook for consumption in the second half of the year.

In the US, despite the Federal Reserve’s decision to leave the target rate range at 5.00% to 5.25% in June, markets are now pricing Fed rate cuts will be delayed until early 2024. The key driver has been Fed Chair Powell’s hawkish commentary throughout the month, which emphasised that the slower pace of rate hikes does not portend an abrupt change in monetary policy settings. Additionally, a 0.4% increase in the May core CPI reading at 5.3% year-on-year confirmed that underlying inflation in the US remains strong. US labour market statistics released in June offered further support for hawkish policy, with jobless claims falling by 26,000 from the recent 18-month high, and non-farm payrolls rising 306,000 against an expected 190,000. Additionally, the US Conference Board Consumer Confidence Index reflected a brighter consumer outlook for business and employment conditions, jumping markedly from 102.5 to 109.7 in June – the highest level since January 2022.

In summary, June highlighted the lagged impact of the Fed’s monetary policy tightening across the US economy. A weak US ISM Manufacturing print in early June of 46 versus an expected level of 47.1 suggests the US manufacturing sector may be sliding into recession, whilst the US ISM Services Index printed a strong result at 53.9 versus 50.3 the month prior which indicates strong employment conditions continue in the services sector. Meanwhile, the housing sector, one of the first US sectors hamstrung by the aggressive rate hikes of 2022, showed early signs of recovery, with new home sales up 12.2% on the month versus expectations for a 1.2% decline, and reaching its fastest annual rate in a year.

The European Central Bank (ECB) raised its deposit rate in June by 0.25% to 3.5%, holding firm with its hawkish rhetoric. The divergence within the June European CPI releases highlights the ECB’s challenges in tackling inflation across the European continent, as Eurozone headline inflation moderated from 6.1% to 5.5% year-on-year, but core inflation picked up 0.1% to 5.4%. Whilst inflation levels in May moderated across Germany, France and Italy, they remain stubbornly high at 6.3%, 6.0% and 8.0% year-on-year respectively. Concern over the German economy grew, as it recorded a weak Manufacturing PMI at 40.6 versus a 41.7 estimate. This stemmed from a sustained deterioration in new orders across the sector in addition to rapidly declining backlogs, pointing to slowing demand. German bonds remain inverted in reaction to the weak economic outlook, with the 2s10s yield differential reaching -87 basis points – its widest level since 1992.

UK inflation again surprised to the upside in June, with May headline inflation remaining elevated at 8.7%, while core inflation rose to 7.1% from 6.7%. Annual British wage growth soared 7.2% in the three months to April, whilst unemployment fell to 3.8% against expectations of a small rise to 4%. The Bank of England responded to these signs of more embedded inflation by increasing rates by 50 basis points to 5%, and markets now expect the UK cash rate to peak above 6%.

China’s rebound following the unwinding of severe COVID-19 restrictions continues to be lacklustre. Retail and industrial production have remained weak, while youth unemployment has continued to rise, reaching 20.8%. In contrast to most major economies, China now faces the risk of deflation with CPI flat year on year in June. The Caixin Manufacturing and Services PMI both fell at a greater pace than expected in June, falling from 50.9 to 50.5 and 57.1 to 53.9 respectively. In reaction to the ongoing slower than expected growth, Chinese authorities reduced lending rates by 10 basis points, however, markets remain unconvinced this will be a strong enough response to recharge growth.

Overall, June was a strong month for risk assets given signs of moderating inflation and economic resilience in the US. Correspondingly, developed overseas equities continued their strong performance, and benefitted from the ongoing positive hype surrounding AI and technology stocks. Its monthly return was 5.6% in Australian dollar-hedged terms, whereas domestic equities had small but steady gains of 1.7%, hampered by China’s gloomier economic outlook. Despite China’s woes, the Australian dollar clawed back some of its year-to-date losses in June, rising to 0.67 US dollars due a tighter domestic monetary policy outlook. Fixed income assets saw some divergence in June, with treasury yields continuing to invert further as markets pushed rate cuts out to 2024, but the outlook for credit improved somewhat, with credit spreads reducing slightly. The net effect was small capital losses of -0.3% for overseas fixed interest, whilst Australian fixed interest had more substantive losses of -2% given smaller credit exposure and the largely unexpected RBA tightening in June.