Investment update - July 2023

Market update

While July saw continued hiking from central banks, there was an overall dovish tilt in market sentiment. With inflation across a number of economies starting to meaningfully abate, the prospect of a ‘soft landing’ remains an increasingly possible – albeit still challenging – prospect. Accordingly, there are growing signs central banks are approaching a peak in their rate tightening cycles, leading to risk assets rising over the month. However, the cost in terms of the negative effect on economic growth remains to be seen, with leading indicators in many major economies pointing to further weakness, notwithstanding that economic growth has remained more resilient than previously expected to date.

The major Australian economic data release in July was the second quarter Consumer Price Index (CPI) report, which revealed that headline CPI was weaker than consensus, falling 1.0% to 6.0% year-on-year. The trimmed mean, which is considered a more pertinent gauge by the Reserve Bank of Australia (RBA), also fell from 6.6% in the first quarter to 5.9%. Both goods and services inflation eased, suggesting its rate hikes have made progress in containing inflation.

Employment data for June, released mid-July, also reflected the Australian economy’s resilience. The unemployment rate remained at 3.5% - only a few basis points below the several-decade low observed in late 2022.

Australia’s housing market continued its rebound since early 2023, with prices rising 0.8% across capital cities over July, and have now risen 5% since their February 2023 low. That said, the July price increases were at a moderated pace relative to recent months. Additionally, other housing data suggests a further slowdown in price growth may eventuate – housing finance approvals (excluding refinancings) edged down 1% in June despite consensus forecasts of a slight increase, while total dwelling approvals fell 7.7% in the same month, taking the year-on-year decline to 18%.

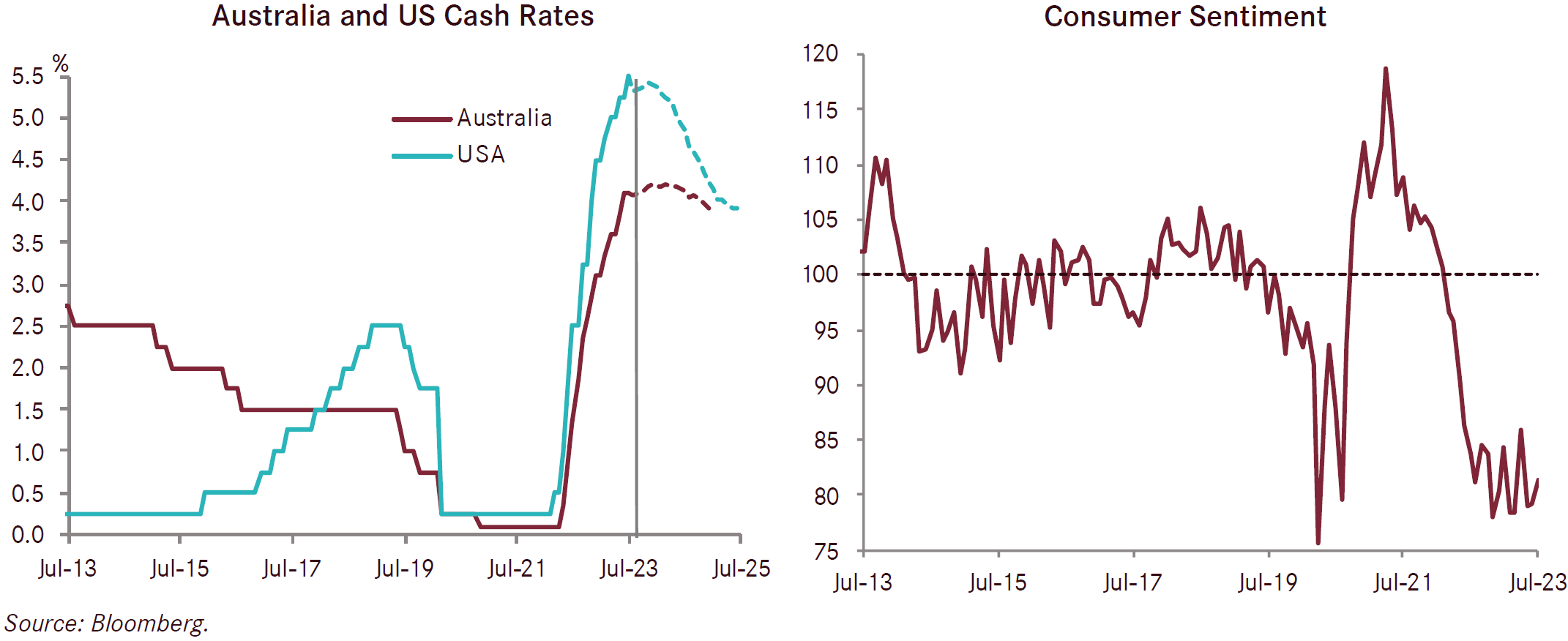

Sentiment indicators continued to suggest a mixed outlook. The NAB survey showed business conditions falling one point to +10, while business confidence increased 3 points to a slightly positive +2. Consumer sentiment measured by the Westpac-Melbourne Institute, however, remained deeply pessimistic and close to historic lows, falling 0.4% to 81, with concerns of continued RBA rate hikes and cost of living pressures cited the main contributors to the decline.

The RBA decided to leave the official cash rate unchanged at 4.10% for a second straight month in early August. The decision reflected a ‘wait and see’ approach by the RBA as the impacts of previous hikes continue to filter through the economy, including the impact of the ‘mortgage cliff’, with many pandemic-era, ultra low rate fixed rate home loans rolling off as 2023 progresses. The two straight pauses by the RBA have significantly tempered market implied forecasts of the Australian cash rate over the coming year, with futures markets in early August suggesting around an even chance of one more hike to 4.35% by early 2024, and at least one rate cut priced in by the end of 2024.

The RBA’s latest Statement On Monetary Policy (SOMP), released in early August, suggests the central bank expects inflation to remain relatively elevated for longer. Revised forecasts have both headline and trimmed mean inflation falling steadily, albeit still at 2.8% at the end of 2025 – at the upper end of the RBA’s target range. The RBA’s unemployment forecast for 2024 remained at 4.4%, but was lowered by 0.1% to 3.9% for 2024. GDP growth for 2023, meanwhile, was cut from 1.2% to 0.9%, and from 1.7% to 1.6% in 2024, reflecting weaker demand than previously anticipated, and an important driver behind the tempered inflation forecasts.

In July, it was also confirmed that Philip Lowe’s seven year term as RBA Governor would come to an end in September 2023, with Deputy Governor Michele Bullock to replace him.

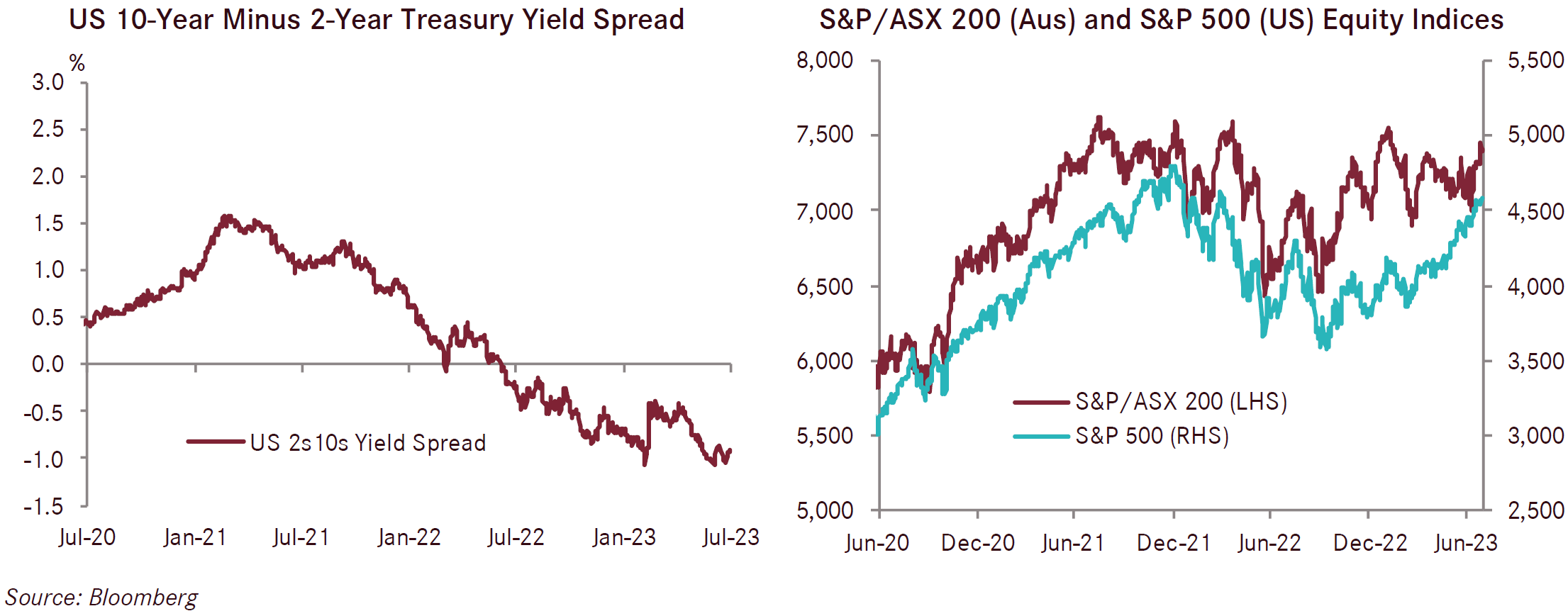

The US Federal Reserve raised its target rate by 0.25% to 5.25% to 5.50%, with the central bank noting that further rate decisions will be highly dependent on the economic data at the time. With two inflation reports and two employment reports between the latest meeting and the next one in September, there is ample scope for a tilt in positioning. That said, consensus suggests little change near-term - as at early August, market pricing implied a steady Federal Reserve target rate over the remaining three meetings of 2023, however it suggests a consensus of five rate cuts over the next calendar year, with a target rate of 4.00% to 4.25% by December 2024.

Eurozone core inflation for June remained flat at an annual 5.5%, although services inflation edged upward to an annual 5.6%. While the European Central Bank raised policy rates by 0.25% as widely expected in its latest meeting, President Lagarde offered little in the way of forward guidance and seemed dovish in her language after the meeting, echoing the language of US Federal Reserve Chair Powell in future decisions being more ‘data dependent’. Similarly, the Bank of England raised the bank rate 0.25% to 5.25% in early August, with the Monetary Policy Committee citing strong wages and GDP growth as key factors. Despite a material slowdown in year-on-year headline inflation from 8.7% to end-May to 7.9% to end-June, the MPC considered that inflationary risks retain an upside skew, with two MPC members voting for a 0.5% hike.

In China, second quarter GDP of 0.8% (6% on an annual basis) proved disappointing given the significant post-COVID reopening at the end of 2022, with consensus forecasts expecting a 6.3% annual figure. Official manufacturing PMI increased slightly to a still contractionary 49.3, although new orders and raw material inventories improved materially. The official services PMI, meanwhile, declined to a moderately expansionary 51.5. The readings suggest excess capacity remains in the Chinese economy; a trait likely to come under further pressure amid a slowdown in aggregate demand from developed economies and the contribution of exports to China’s GDP.

There was a major policy development in Japan in late July, with the Bank of Japan loosening its yield curve control over the ten-year government yield. While it will continue to permit the yield to be 0.5% above or below 0.0%, it will buy the bonds at 1.0% via fixed rate operations. The move effectively lifts the cap on ten-year yields to 1.0% and saw 10-year yields rise from 0.44% to over 0.65% - the highest in nearly a decade. While a small absolute change, the increase suggests a higher chance of a departure from the central bank’s nearly quarter-century policy of yield curve control should inflation prove persistent.

Equities recorded a relatively strong calendar month both in Australia and overseas, returning 2.9% and 2.8% (on an Australian dollar hedged basis), respectively. The uptick in prices was driven by weaker inflation prints in a number of developed markets, suggesting a potentially less aggressive central bank policy path than had previously been anticipated. More resilient economic data in the US and Europe also supported returns. Emerging markets were the strongest equity class for the month, returning 4.9% on an Australian dollar unhedged basis. Suggestions of Chinese government support for real estate and rising commodity prices lifted returns, while Turkey – the strongest performing equities market for the month - regained significant ground lost following Erdogan’s election win – a result considered unfavourable to the local economy.

Fixed interest returns were relatively muted despite the weaker inflation forecast, with yields spiking then falling intramonth, but little-changed month-on-month. Credit spreads were similarly little changed over July, falling slightly overall. As a result, both Australian and overseas fixed interest returns were near-zero for the month.