Investment update - April 2023

Market update

April saw continued improvement in investment sentiment following bank collapses in the US and Europe in March, with the risk of contagion seemingly averted for now by swift regulatory action. That said, in early May there were renewed fears concerning a number of additional US regional banks. While some central banks signalled a pause in rates over March and early April, policy tightening continued into May, with the easing of contagion risks a double-edged sword, improving sentiment but also encouraging central banks to hike rates amid a tight labour market and persistently high core inflation.

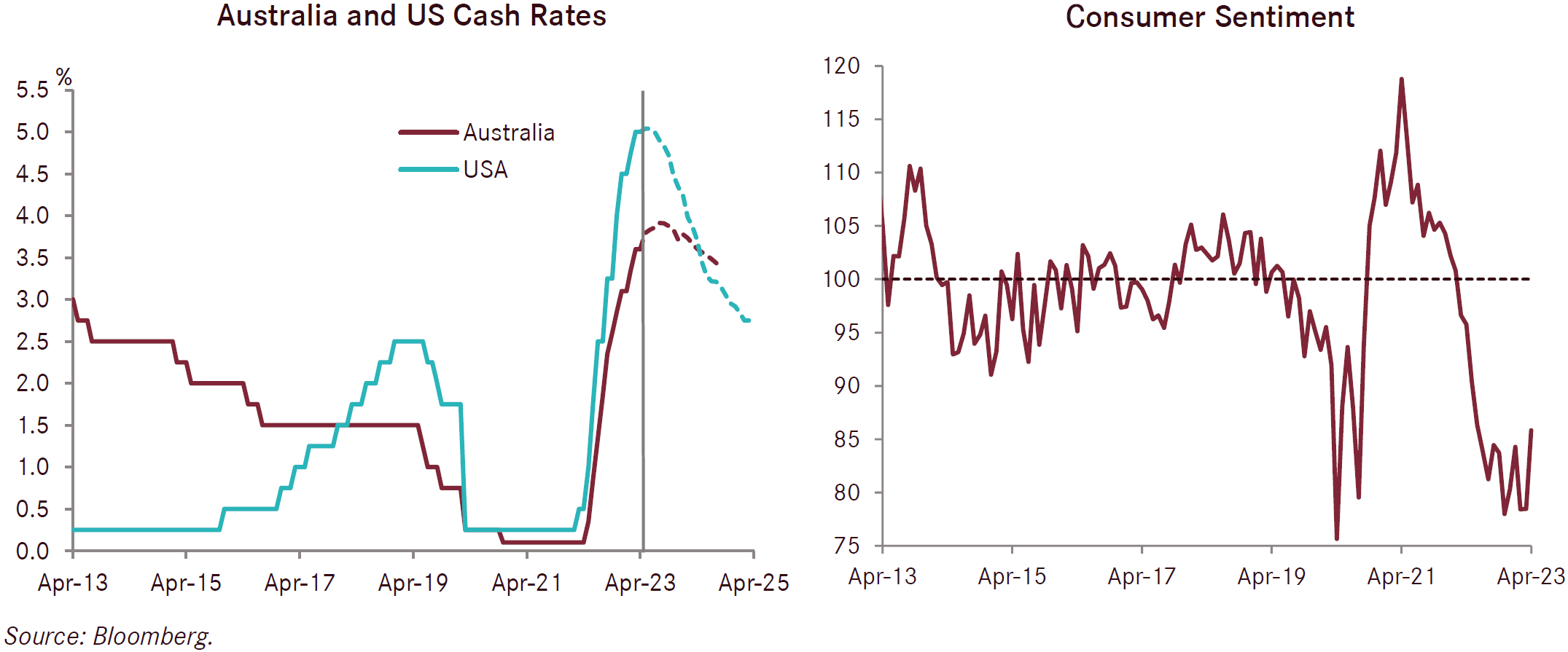

In Australia, first quarter inflation data was perceived to be dovish on release, with trimmed mean coming in below consensus at a year-on-year 6.6%. Broad decreases in goods inflation, especially across recreation, food and clothing were key drivers. Services inflation posted a material increase due to rising healthcare costs, although these components are likely excluded from the trimmed mean. The decline in the trimmed mean – a key metric cited by the Reserve Bank of Australia (RBA) in its policy outlook in early April – led to a consensus view that the RBA would pause for a second straight meeting in early May. However, with easing conditions in the global financial sector since the collapses of the likes of Silicon Valley Bank and Credit Suisse, the RBA considered it appropriate to hike the official cash rate 25 basis points to 3.85% in early May. The move shocked markets, leading to a surge in short-end Australian bond yields. While the RBA noted that further hikes were possible, market-implied pricing continues to suggest limited upside risk, pricing in no further hikes, and instead anticipating a sharper decline in the OCR to around 3% by end-2023.

There was little of note in terms of the Australian jobs data, with the unemployment and participation rates holding steady at 3.5% and 66.7%, respectively, with around 53,000 new jobs added overall.

Sentiment data before the early May RBA hike reflected growing optimism. The Westpac-Melbourne Institute consumer survey saw a 9.4% increase in April, with the RBA’s April pause providing a considerable tailwind, particularly for mortgage holders and residential property owners. That said, the survey index remains comfortably in overall pessimistic territory. The NAB Business survey was more mixed for the month, with conditions falling by 1 point to a still positive +16, while business confidence increased 3 points to -1. Overall, the business outlook was noted as pessimistic.

Despite the cash rate being at its highest point in a decade and credit availability increasingly restricted, house prices recorded a second straight month of positive price growth, rising 0.7% nationally in April. While prices are still down over 8% year-on-year, the robustness in the market coupled with a return to high immigration levels has led to a number of leading economists reviewing their outlook for the sector and suggesting property prices may have bottomed out amid low vacancy rates.

In the US, the Federal Reserve’s Open Markets Committee (FOMC) met expectations by raising the target rate 25 basis points to a new range of 5.00% to 5.25%. Powell also signalled a conditional pause in hiking, noting the impact on credit availability arising from recent US regional bank concerns as well as the lagged impact of the FOMC’s rapid pace of hikes. Market pricing as at early May suggests the chances of a 25 basis point cut remains a possibility in late July, with the target rate forecast to fall to 2.75% to 3.00% by the end of 2024 - though this would be counter to the FOMC’s own projections.

While the Fed’s rate hike followed relatively muted jobs data, it preceded an upside surprise for April, with non-farm payrolls recording 253,000 new jobs added, over 70,000 above forecasts, with the unemployment rate falling from 3.6% to 3.4% . Core CPI, meanwhile, was as expected, with the annual rate slightly rising to 5.6%. The increase was expected, and was due to the stickiness of shelter inflation, which has been driven up by short-term accommodation costs. However, this segment is of less concern for the central bank, with leading rent indictors suggesting a material slowdown in the near-term.

US sentiment data released in early May suggested an increasingly negative economic outlook. The ISM manufacturing survey recorded a contractionary print for April, with production and new orders declining despite some growth in the service sector.

The European Central Bank (ECB) followed its US counterpart in early May, raising its deposit rate 0.25% to a fifteen-year high of 3.25%. The decision was expected and was noted by president Lagarde as almost unanimous among her colleagues. The ECB has noted that the outlook for inflation remains “too high for too long”, with underlying price pressures considered to be uncertain. Despite the uncertainty, Eurozone core inflation has been heading in the right direction – the April reading inched downward to 5.6% year-on-year. That said, the jobs market has remained tight, with March unemployment data released in early May shrinking to a below-expected 6.5%; the lowest since combined Eurozone data was first prepared in 1998.

In China, first quarter GDP increased 2.2% in line with expectations, with the fourth quarter of 2022 revised upward from 0% to 0.6%. As a result, year-on-year growth improved to 4.5%, which was above consensus. With retail sales growth continuing to surge since the start of 2023, rising to 5.8% year-on-year in March, and a healthy rise in residential property sales, it appears that economic momentum in China is firmly heading in a positive direction after lifting its ‘COVID zero’ approach to managing the pandemic.

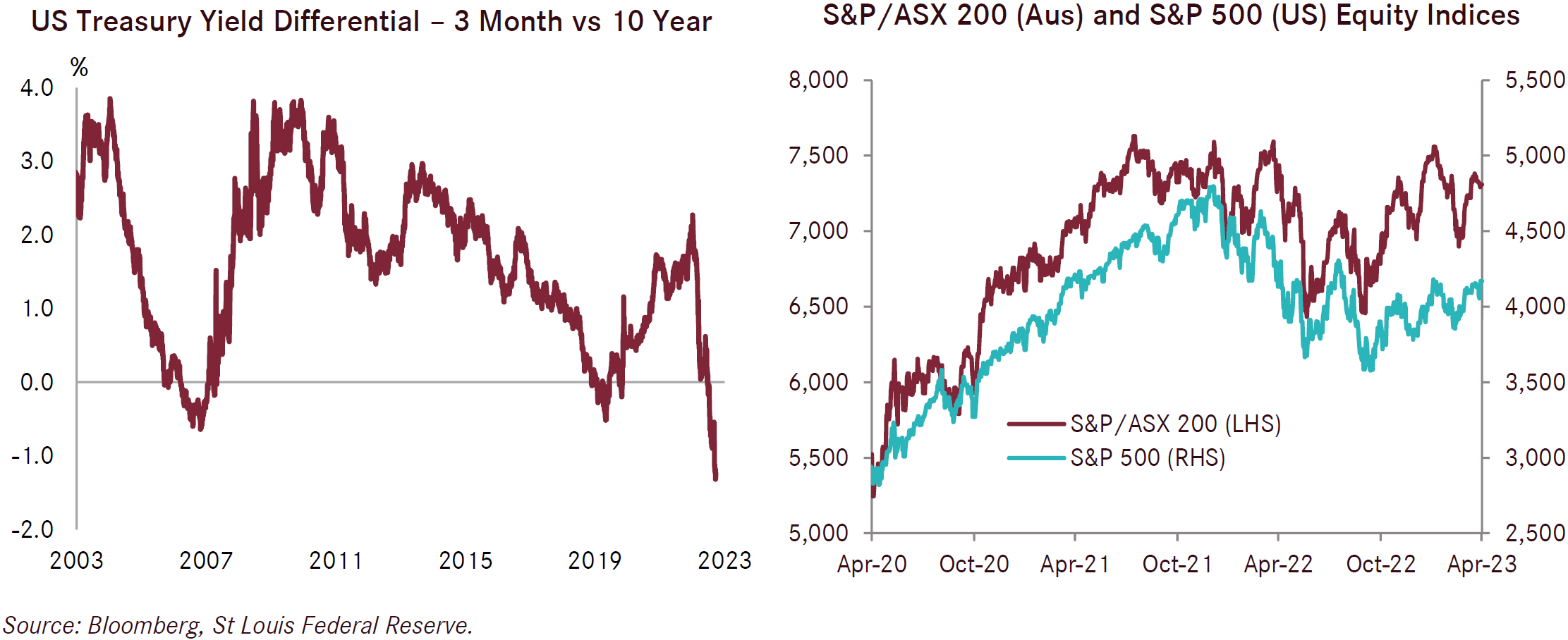

The easing in contagion fears contributed to positive returns for risk assets over April. Developed overseas equities returned 1.6% in Australian dollar-hedged terms, while local equities returned 1.9%. Yields also remained broadly unchanged month-on-month, leading to small positive returns for both overseas and Australian fixed interest. A number of developed sovereign yield curves remain inverted, including the US Treasury curve, which remains at its most inverted level in four decades. An inverted curve is considered an indicator of looming contractionary economic growth.

Over both the last three and twelve months, the clear standout in terms of performance has been unhedged developed overseas equities, which has benefitted from the depreciation of the Australian dollar amid the RBA’s relatively low cash rate settings compared to foreign counterparts. The local currency fell to 66 US cents during April; while above its late 2022 low of 62 US cents, it is now well below its 2023 peak of 72 US cents in January.