Investment update - May 2023

Market update

May saw more cautious markets in response to a string of negative news, retreating from the more positive sentiment of the previous months. The narrative of central banks delivering mid-year rate cuts was quashed by widespread central bank policy tightening in early May. Additionally, the closure of First Republic Bank on the first of May brought with it a fresh round of concerns regarding US regional banks, and the optimism regarding China’s post covid rebound also lost impetus through the month, as geopolitical tensions between China and the US escalated. Most significantly, volatile US debt ceiling negotiations gave rise to fear of a US debt payment default, and the potentially devastating implications for financial markets. That said, an agreement to suspend the debt ceiling until after the next US presidential election alleviated these concerns at the start of June, which has contributed to more positive sentiment in markets since May’s end.

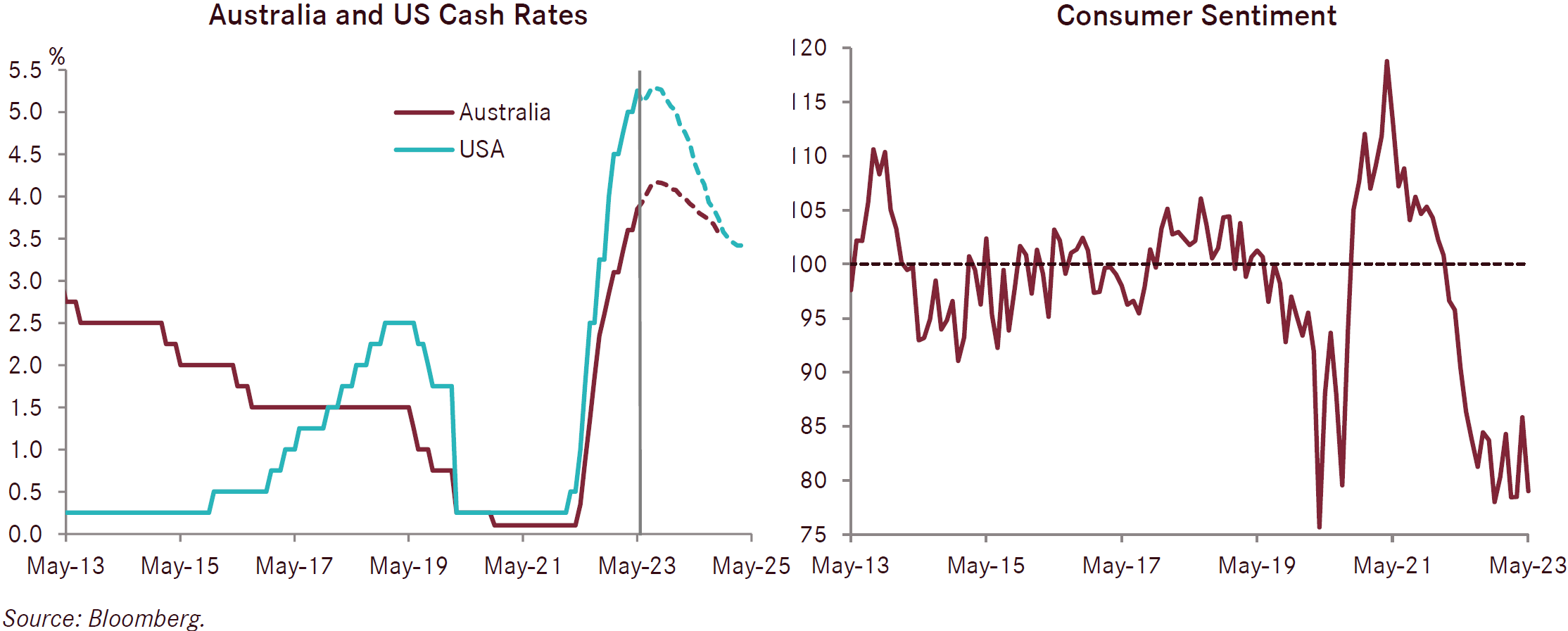

In Australia, the April monthly consumer price index (CPI) indicator was released and recorded an upside surprise, rising from a year-on-year 6.3% in March to 6.8%, above the consensus estimate of 6.4%. This was driven largely by the fuel excise tax rolloff from the annual period, which had contributed to a -13.8% fall in automotive fuel prices in April 2022. The core inflation measure (excluding fuel and food) moved in the opposite direction to headline CPI, instead falling slightly from 6.9% to 6.5%; it remains well above the central bank’s target, however. Rent inflation picked up further, with low vacancy rates and a tightening rental market threatening to be a large contributor to CPI for some time. Having already surprised markets by raising the official cash rate by 25 basis points in early May, the RBA continued to defy expectations with another 25 basis points in early June. This brought the cash rate to 4.1% in Australia, with RBA Governor Lowe remaining resolute that the RBA will ‘return inflation to target and will do what is necessary to achieve that.’

In terms of the Australian jobs data, the unemployment rate increased slightly to 3.7% in April (seasonally adjusted) while the participation rate remained steady at 66.7%, with around 4,300 jobs lost overall. At the end of May, the Government announced that the award rate of pay will be increased by 5.75% at the start of the new financial year, giving pay rises to almost 2.5 million Australians, or approximately 18% of the total workforce, and it likely sends an important signal to an even larger proportion than that during wage negotiations. This will be inflationary as businesses will likely pass on the higher labour costs to consumers to try to maintain their profit margins.

Australian sentiment data in May fell away from the positive sentiment observed last month. The Westpac-Melbourne Institute consumer survey saw a 7.9% fall in April, with the RBA’s surprise May hike causing a deep pessimism particularly for mortgage holders and renters. The survey also pointed to a decline in sentiment in response to the delivery of the Federal Budget, with consumers hoping for more government assistance. The national accounts released in early June echoed the negative outlook for the Australian consumer, with the household savings ratio falling to 3.7%, its lowest level in 15 years. Most households have now fully depleted the cash buffers they accumulated during the pandemic.

In the US, markets traded around the ‘higher for longer’ narrative in May after the US Federal Reserve’s decision to raise the target rate by 25 basis points to a range of 5.00% to 5.25%. The market’s pricing for Fed rate cuts have been pushed out as a result, with 1% of expected rate cuts for this year instead moved out to early 2024. Better than expected US payroll data supported this sentiment, coming in at 339,000 versus 190,000 expected, and driving up US bond yields, particularly at the long-end. However, average hourly earnings rose just 0.3% for the month to be in line with expectations, while the unemployment rate rose to 3.7%. Jobless claims continued to steadily rise to 18-month highs, and year-on-year CPI came in at 4.9% for April, slightly less than the 5% estimate and the lowest level for 24 months. Overall, the data indicates that the Fed’s hawkish actions are slowly working to quell inflation, driving the market’s expectation that the Fed will pause at its mid-June meeting.

The intense US debt ceiling negotiations, as well as the closure of First Republic Bank, contributed to a general risk-off sentiment permeating broadly through markets in May. The bearishness in financial markets induced by US debt ceiling negotiations concerned the potential for a default on US government debt due at the start of June, which if it eventuated would have had significant implications for the US economy, and financial markets more broadly. US sentiment data released in early June continued to slide towards an increasingly negative economic outlook, partially as a result of this risk. Conference Board Consumer Confidence slipped to 102.3 in May from 103.7 in April. However, an agreement in the eleventh hour struck between the Republican-led House and President Biden subdued these fears, with markets reacting positively to the news in early June.

The European Central Bank (ECB) and Bank of England (BOE) both raised their official rates in early May by 0.25% to fifteenyear highs of 3.25% (deposit facility) and 4.5% respectively. Though falling, inflation is proving more stubborn than expected in the UK, with April headline CPI coming in at 8.7% compared to the BOE’s 8.4% expectation, and more worryingly, core CPI rose from 6.2% to 6.8% (compared to consensus expectations for no increase at all), suggesting inflation may be becoming somewhat embedded within the broader economy. Meanwhile, both Eurozone headline and core CPI are moderating at a better than expected rate, falling to 6.1% and 5.3% respectively in May. However, ECB President Lagarde quickly reinforced the central bank’s message that inflation was still too high and that more rate rises would be needed to reach the 2% target, particularly considering the tightness of the labour market in Europe, with the unemployment rate falling to a record low of 6.5% in April. UK manufacturing and services PMIs both fell by -0.7 and -0.8 respectively in May, and those for the Eurozone by -1.0 and -0.3 respectively, suggesting that with inflation declining progressively, rising interest rates are achieving their purpose of slowing down European economies to better balance supply and demand.

After a strong start to the year, whereby first quarter GDP increased 2.2%, the optimistic narrative surrounding China’s economic rebound from the lockdowns enforced during its ‘Zero-COVID’ approach soured somewhat in May. China PMI data disappointed expectations this month, as the manufacturing index fell to 48.8 from 49.2, and the non-manufacturing index declined to 54.5 from 56.4; both suggest weakening demand expectations from China, crimping commodity prices. Additionally, China’s youth unemployment issues were further confirmed, with joblessness among 16-to-24-year-olds shown to be nearly double pre-pandemic levels at 20.4%. There were also growing concerns over tensions between China and the US in May, as levels of trade between the superpowers has continued to shrink to the lowest level in 10 years due to the US diversifying its imports away from China.

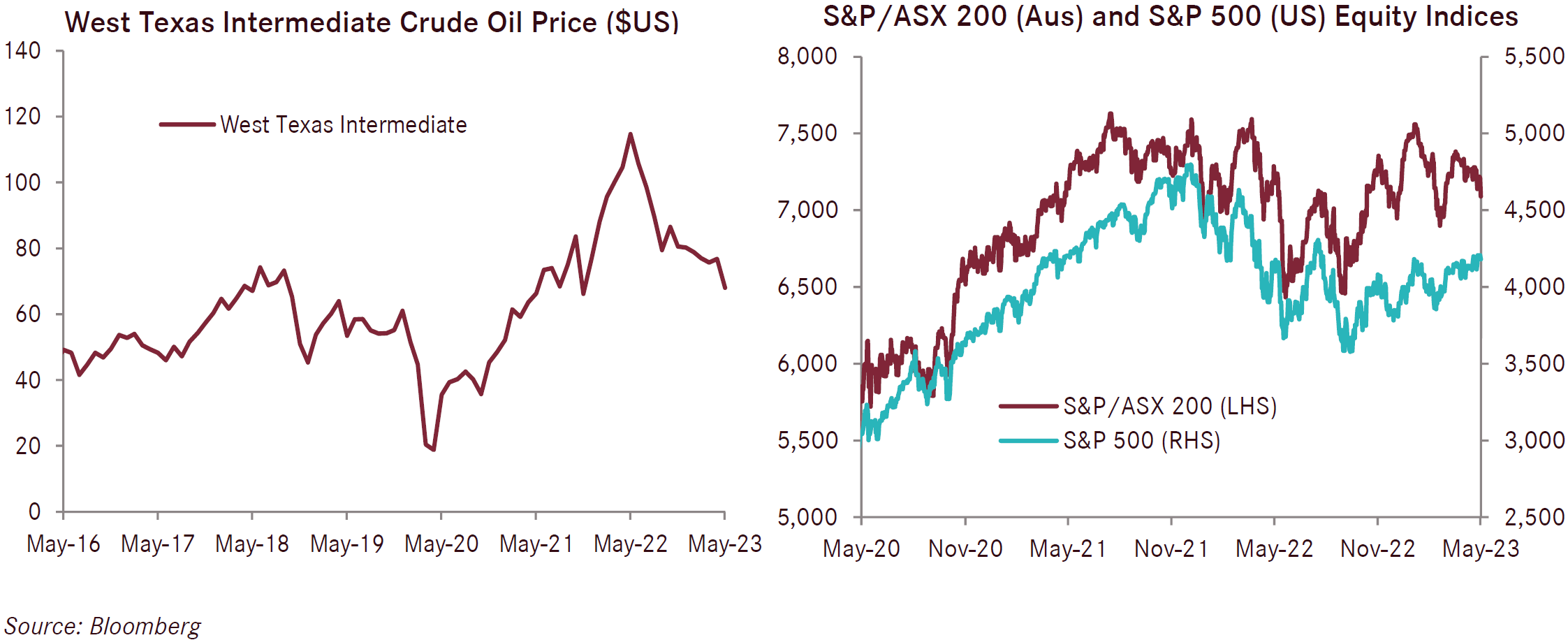

The string of largely negative events throughout May prompted a poor month for risk assets. However, developed overseas equities performed well on a relative basis, benefitting from a wave of excitement surrounding artificial intelligence that saw a select number of technology stocks’ valuations soar (most notably NVIDIA). This partially offset the broader index’s poor performance, with a monthly return of -0.2% in Australian dollar-hedged terms, whilst local equities performed worse and fell by 2.5%. A more pessimistic outlook on China also induced a swift drop in commodity prices, and the West Texas Intermediate crude oil price fell -11.3% month-on-month, and -40.6% year-on-year. Consistent with this, the Australian dollar has also suffered, falling to 0.65 despite the RBA’s unexpected decision to hike in May. Bond yields also climbed in response to the flurry of rate hikes taking place across the world, leading to small capital losses for both overseas and Australian fixed interest.